2019 Startup Outlook

US Report

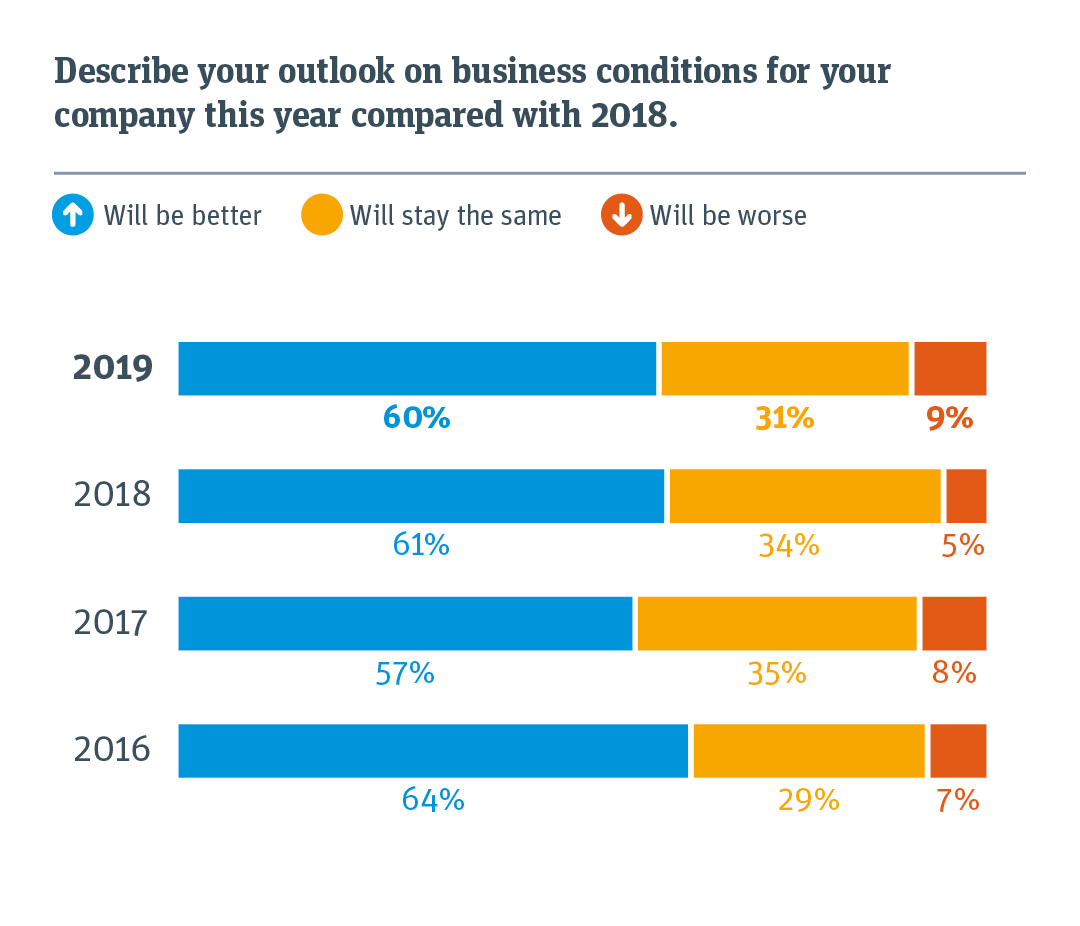

AMID VOLATILITY, US STARTUPS STAY POSITIVE

Most US startups believe that 2019 business conditions will improve over last year. Entrepreneurs are optimists, and even given economic and political volatility, this year is no different. They also recognize the challenges they face, including fundraising, access to talent and US-China trade policy. On a positive note, the percentages of women gaining startup leadership positions on the board and in the C-suite are growing after remaining static. Looking ahead, we asked which technologies will have the most promise in a decade: US startups say AI, autonomous transportation and life science.

Jump to Business Conditions | Funding | Hiring & Talent | Public Policy

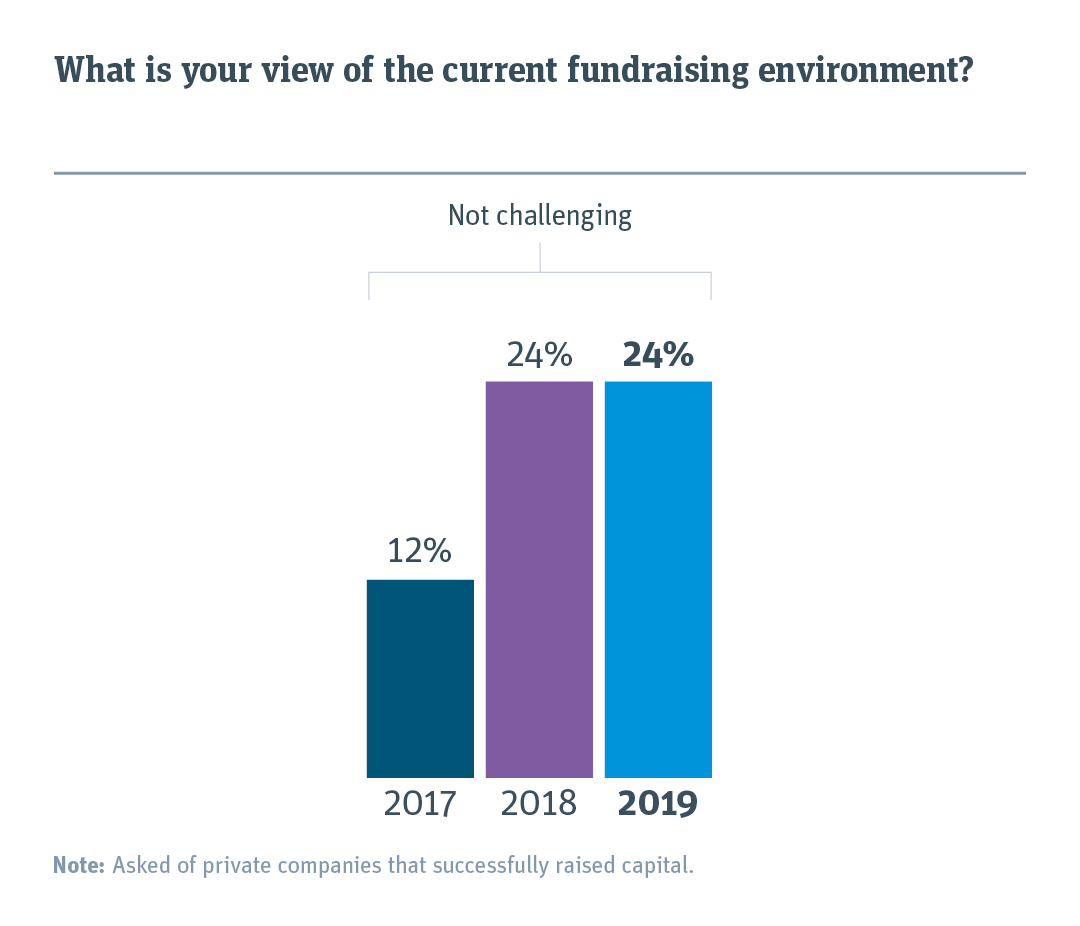

Raising capital grows easier in the past two years

Seventy-one percent of US startups surveyed successfully raised capital in 2018. Of those, one-quarter say the current fundraising environment is not challenging. VCs and private equity firms have been investing larger rounds in fewer deals, focusing their capital on high-performing startups; however, pre-revenue companies and those with smaller revenue streams describe raising capital as considerably more challenging.

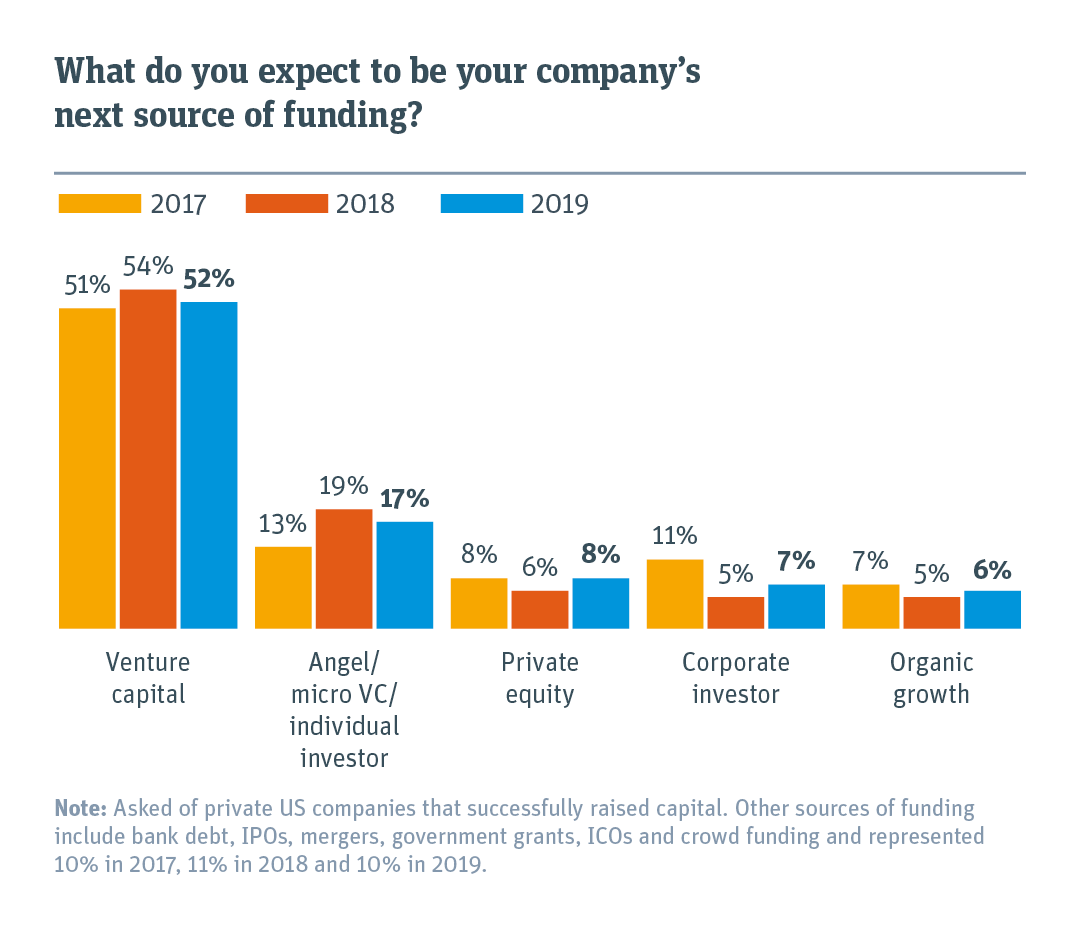

Venture capital is the go-to source of funding

Alternative financing sources are a topic of great discussion among startups and the media. Still, half of US startups say they expect their next source of funding to be venture capital — a steady level over the past three years. Another 17 percent say they expect to tap small or individual investors for their next funding round.

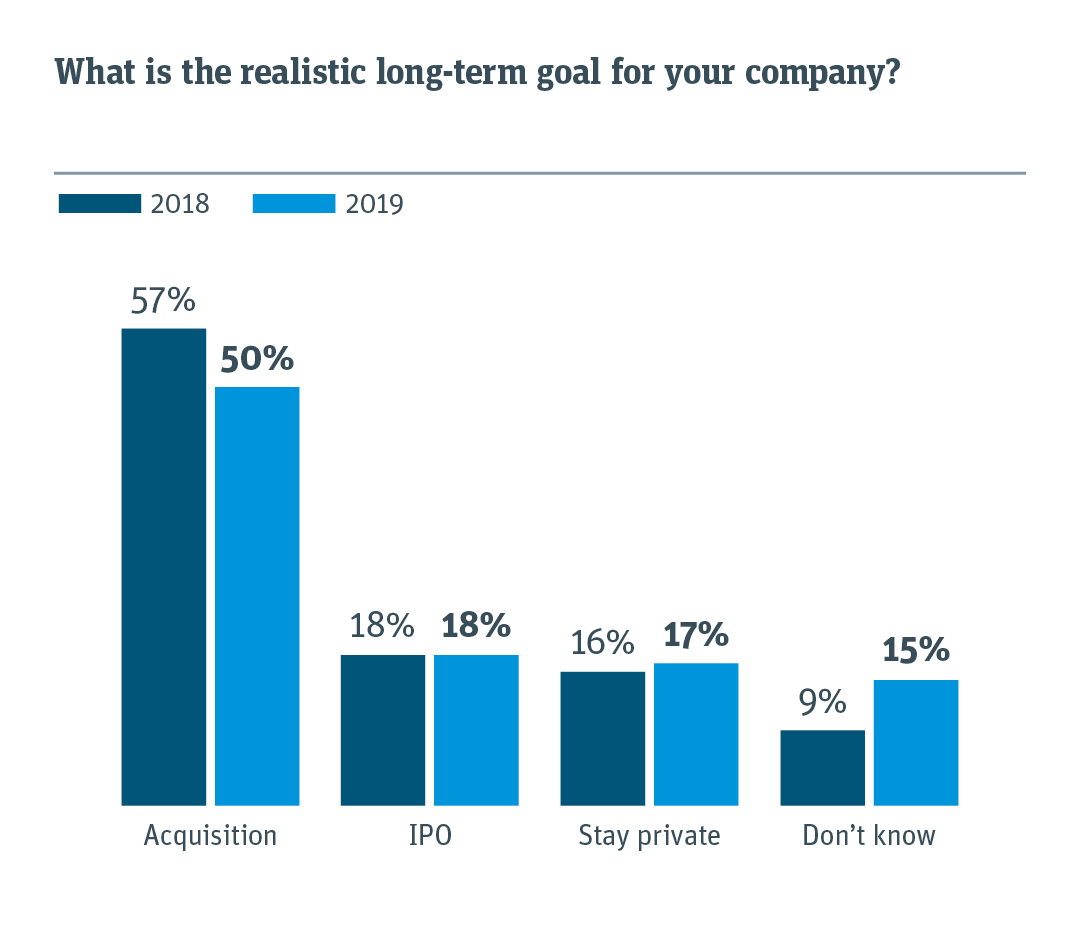

Startups say the most realistic goal is acquisition

Several unicorns are lining up for possible 2019 IPOs. But most US startups say their more realistic long-term goal is to be acquired — long cited as the most common path to an exit. A larger percentage of startups compared with a year ago say they don’t know what their ultimate goal is, underscoring the difficulty of planning an exit amid increased market volatility.

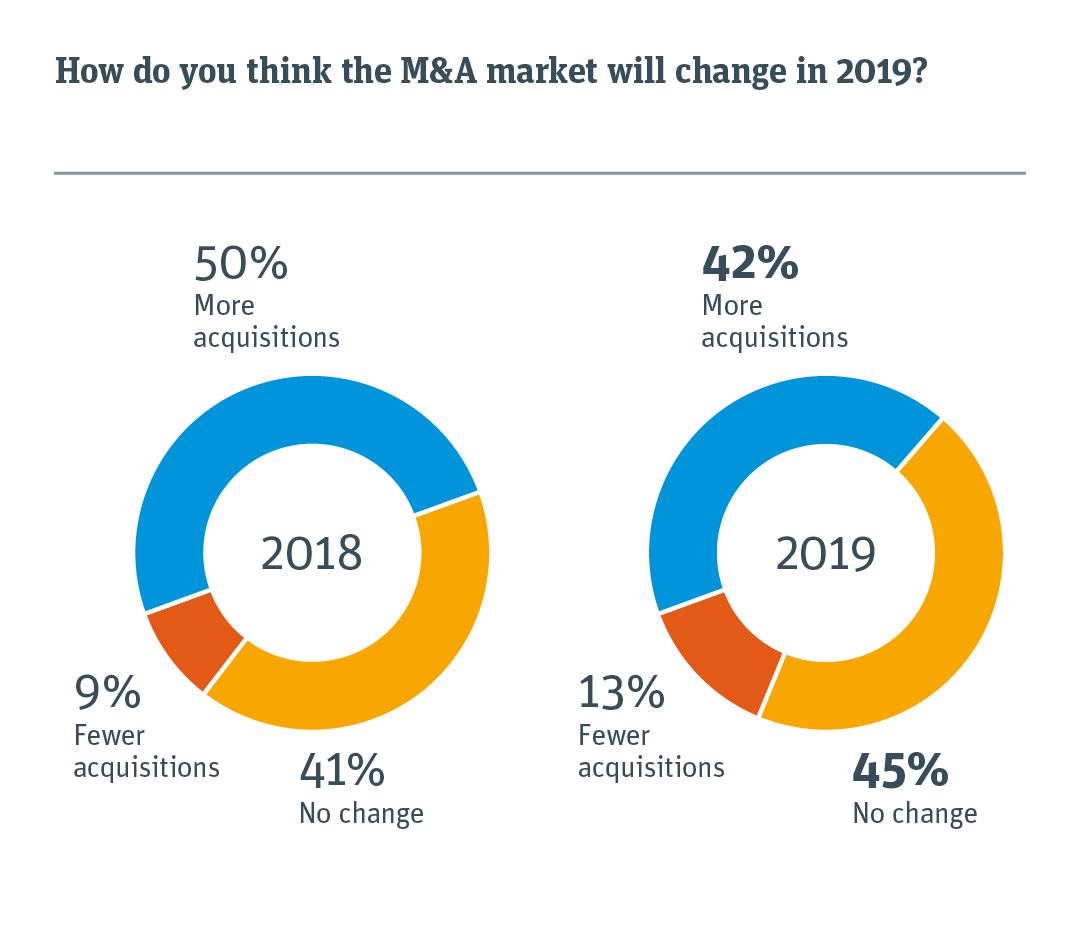

M&A activity is healthy

Nearly 90 percent of US startups believe that M&A activity will maintain 2018 levels or increase. With plentiful capital available, many corporations, private equity funds and scaling companies have the resources to make acquisitions.

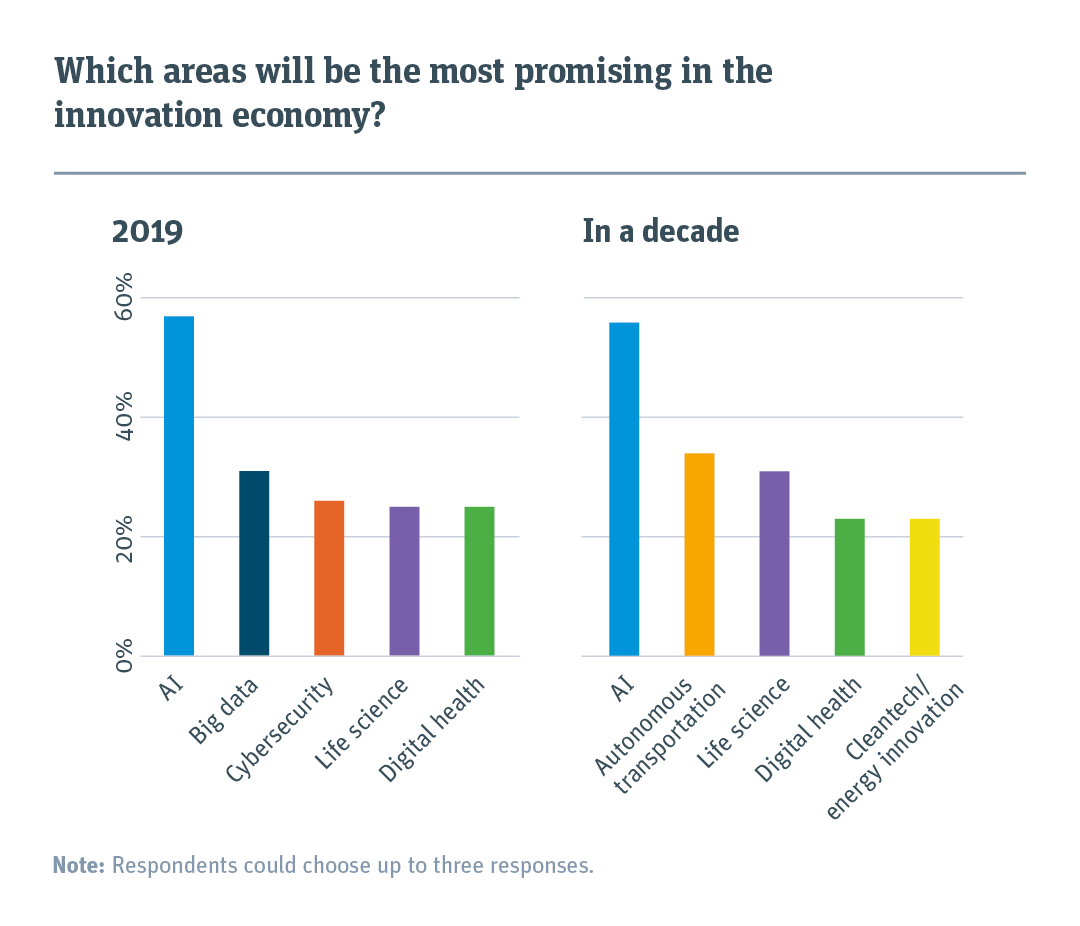

AI is the most promising sector now — and in the future

US entrepreneurs say AI and big data are the technologies with the most promise today. Looking ahead a decade, they expect autonomous transportation to make the biggest leap in potential, taking the second spot after AI.

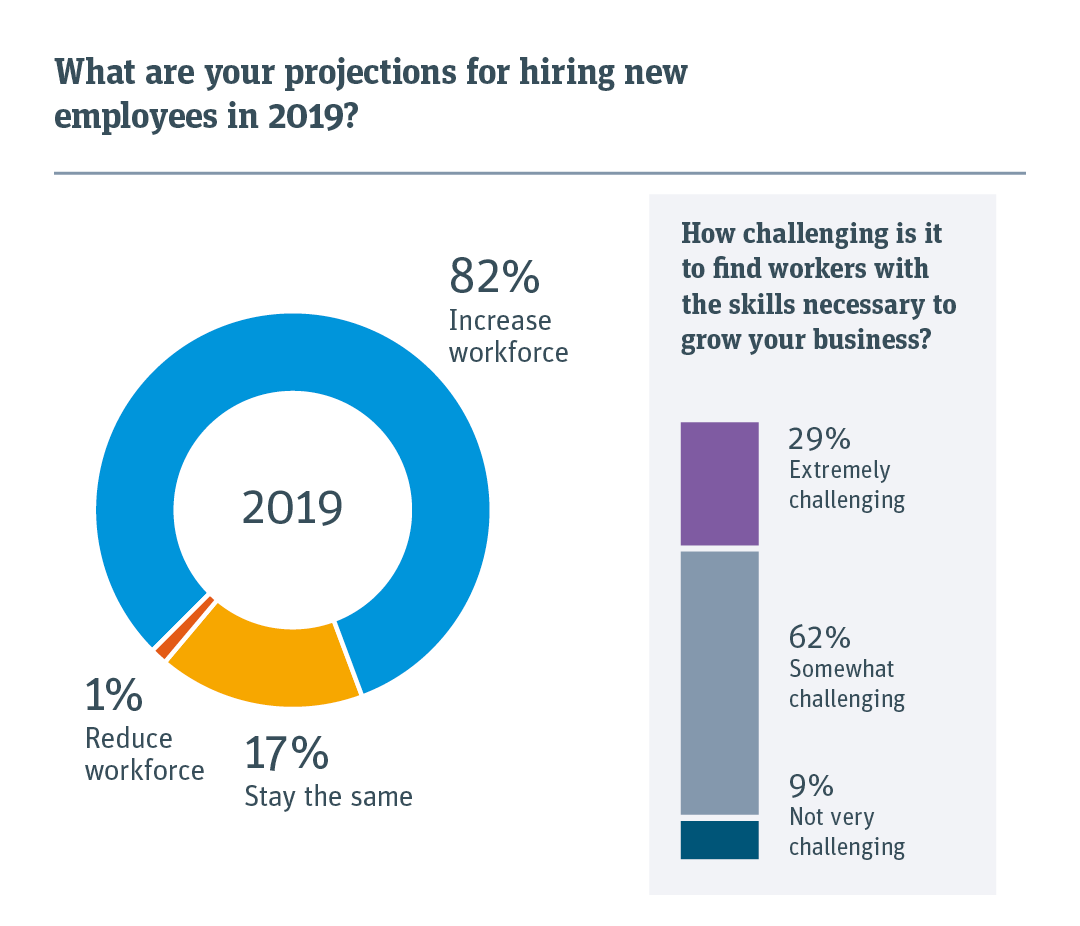

Startups plan to hire but find talent search hard

More than 80 percent of US startups say they plan to add employees in 2019, but 29 percent recognize it is extremely challenging to find talent with the necessary skills to grow their businesses. Another 62 percent say it is somewhat challenging. Startups are most in need of filling product development/R&D, sales and technical positions.

“We need to invest and help drive a bigger talent pool by making STEM education more accessible.”

—CEO, software company

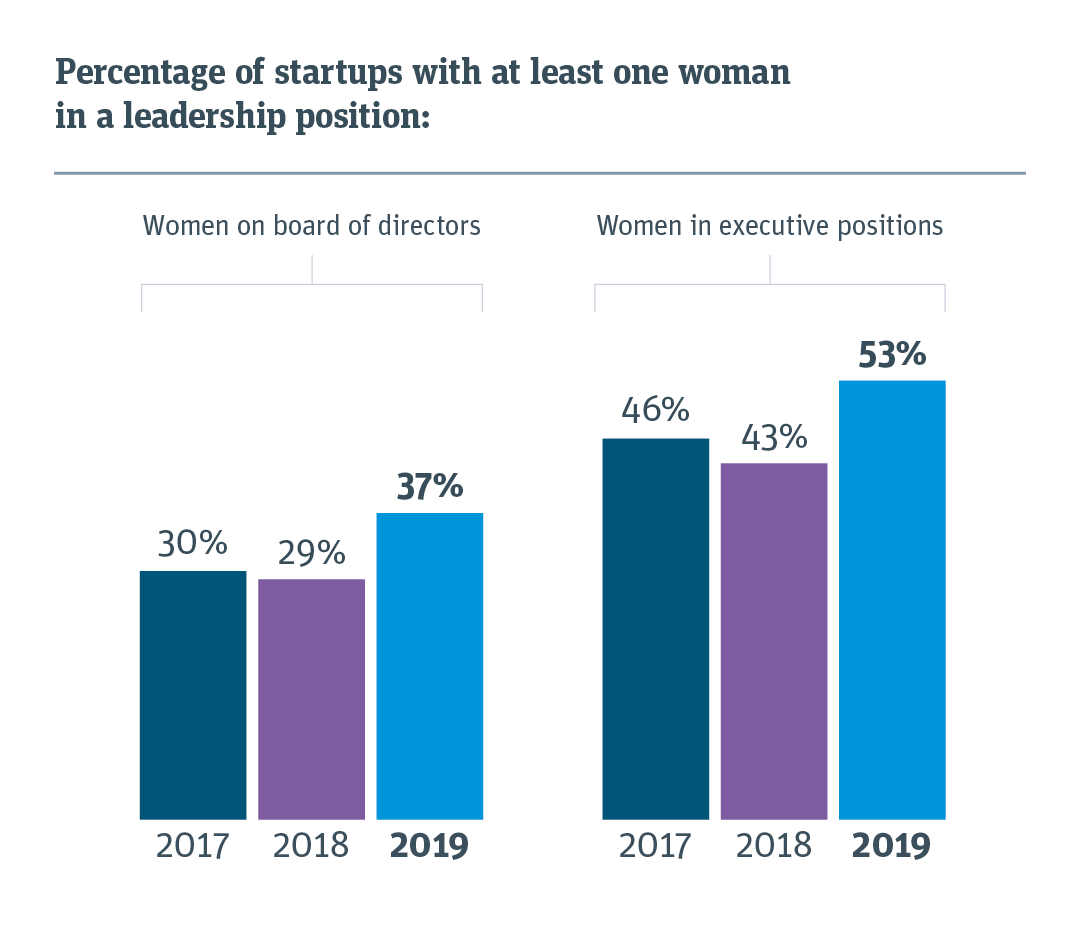

Women are gaining more startup leadership roles

The focus on gender parity in the innovation ecosystem has increased in recent years. While there is still work to be done, US startups are reporting some progress. The percentage of startups with at least one woman on the board of directors has increased to 37 percent — the highest level since SVB started tracking in 2015. The percentage of startups with at least one woman in an executive position is 53 percent, an increase of 10 percentage points compared with last year.

SVB will publish an in-depth report on Women in Technology Leadership in H1 2019.

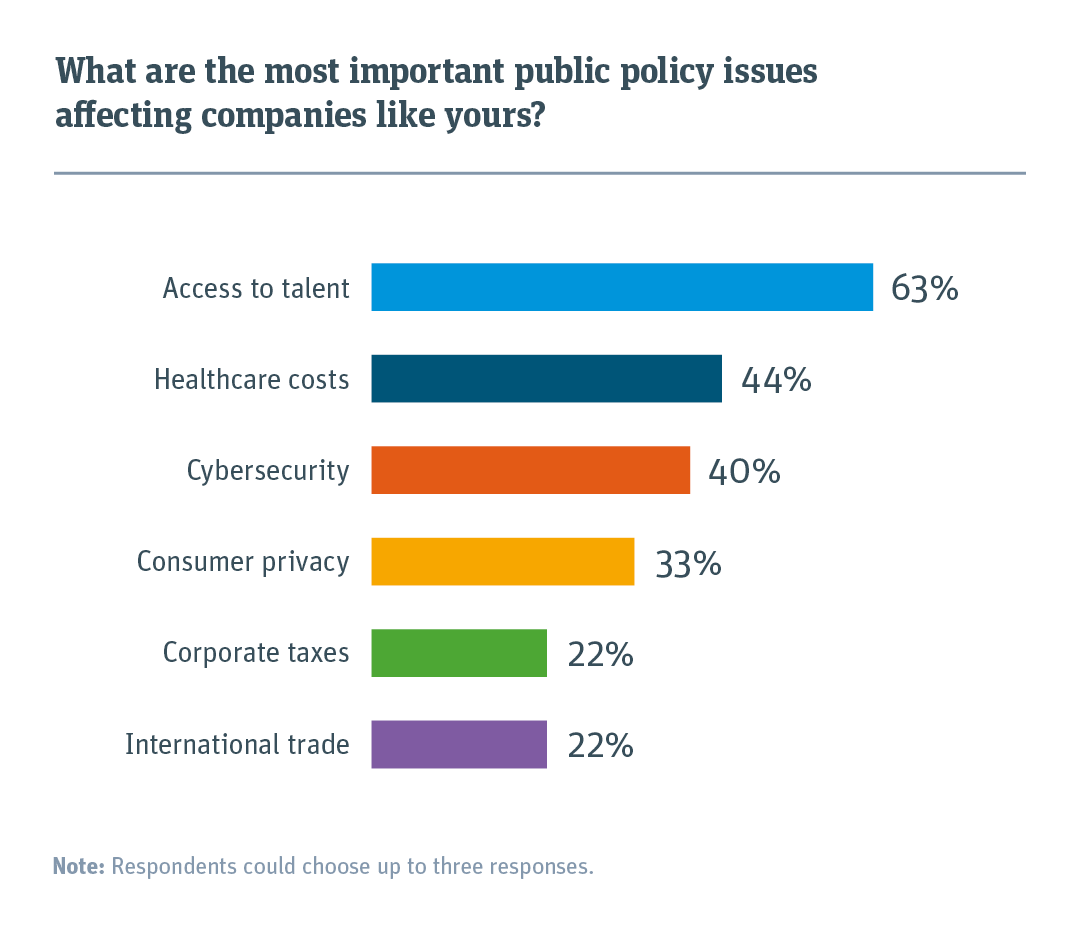

Access to talent is the top policy concern

As in past years, a majority of US startups say access to talent is the most important public policy issue affecting companies like theirs. Concern over healthcare costs for employees and cybersecurity also rank highly. And more startups are citing consumer privacy than in the past.

“The current rhetoric is sending good foreign-born talent overseas, while we’re not doing much to build the infrastructure to ensure that US residents can also be well-trained for these jobs."

—CEO, cleantech company

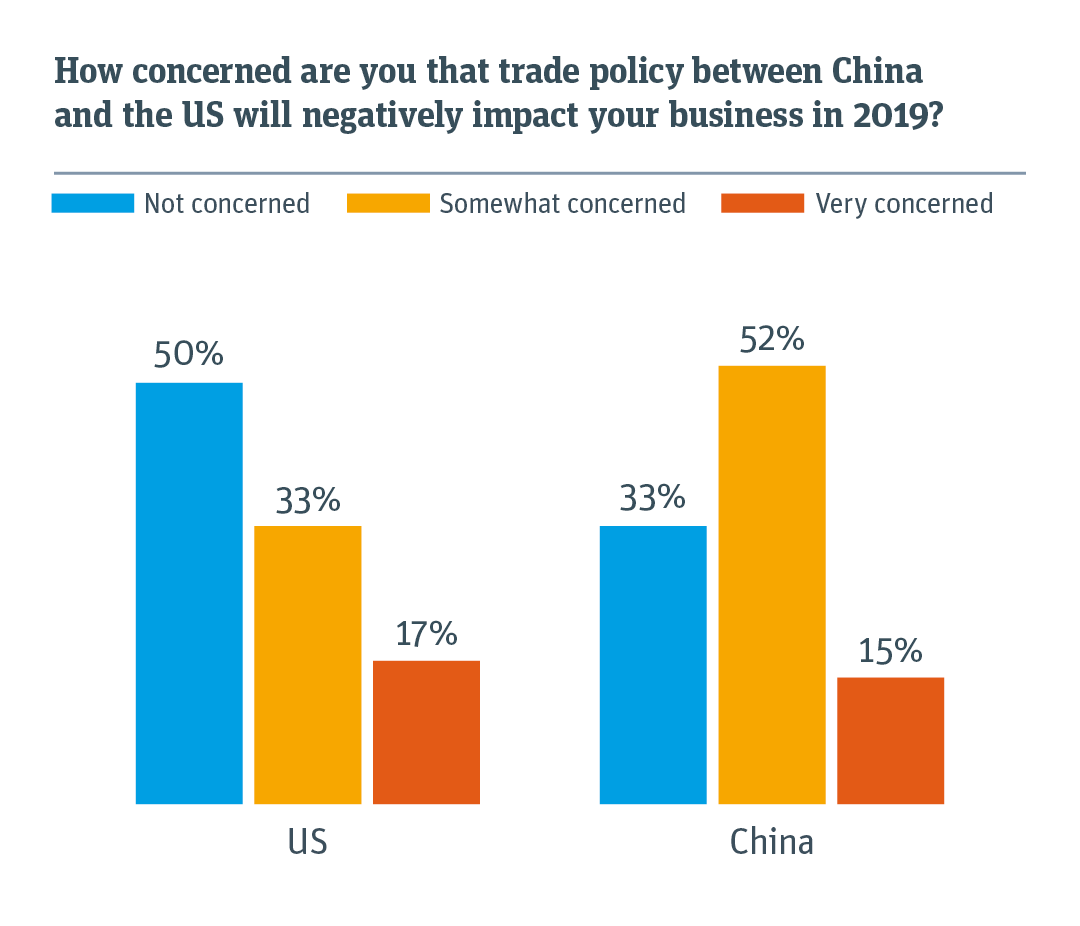

Many US startups are uneasy about China trade policy

Half of US startups say they are concerned that trade policy between the US and China will hurt their businesses in 2019. Two-thirds of Chinese startups express concern about a negative impact.

“The US-China trade war is an unknown risk. We need a stable operating environment.”

—COO, software company