Summertime, for many of our clients, is the best season for taking some time away from their business and turning their attention to more personal things such as family and financial housekeeping. Hopefully, it is a time for you to recharge and go on vacation. Whether you are resting or getting ahead this summer, this is a great time of year to get your personal financial house in order and attend to the things that you have been putting off, including putting an estate plan in place or an insurance review. We highly encourage our Private Banking and Wealth Advisory clients to let us help you with updates to your financial plans.

Some commonly discussed mid-year topics with our clients include:

- Mortgage and tailored loan rates are currently at near-historic lows. If you have an outstanding home equity line in addition to your mortgage, now might be a good time to think about refinancing and folding the HELOC into a larger mortgage to reduce the long term cost. For those of you with adjustable rate mortgages that are approaching the end of the fixed rate period within the next year, you should consider looking at your refinancing options. Now is a great time to talk with your advisor about reviewing your balance sheet and optimizing the debt structures you have.

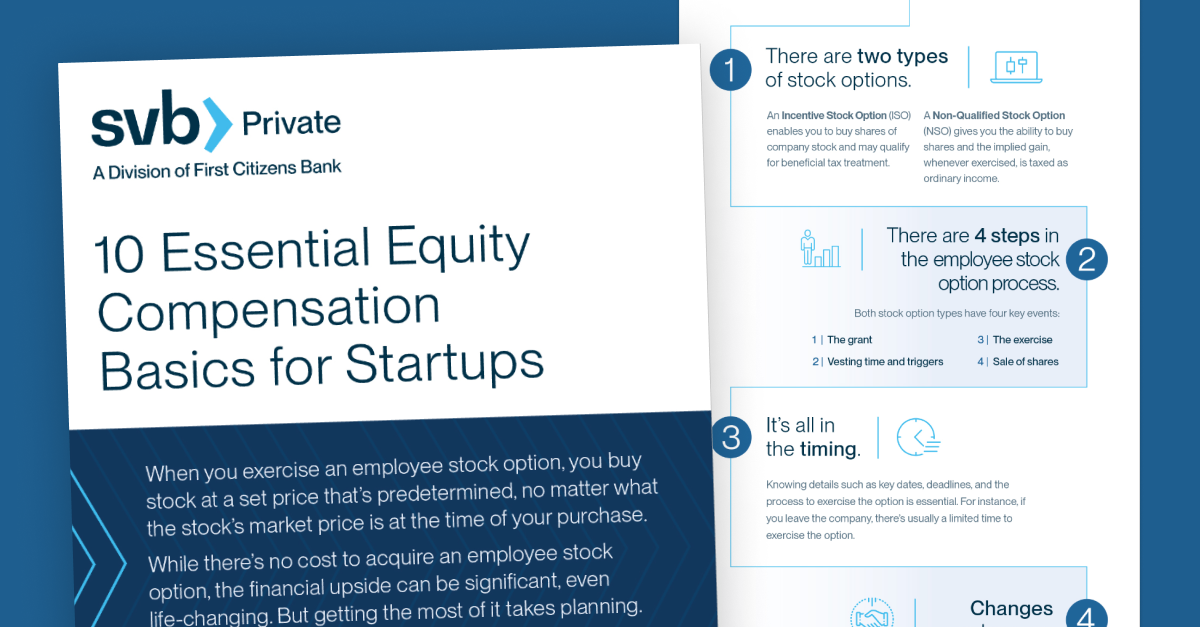

- Start planning your year-end transactional activities now. Is your company raising a round this year? Consider exercising options at least a month in front of that to take advantage of the lower valuation for tax purposes. Individuals in a transition year with lower than normal income may want to consider exercising some ISOs, just be sure to consult with an accountant first.

Investors with stock distributions may consider tax-efficient gifts to Donor Advised Funds or Foundations - be sure to check on QSBS eligibility first. While it can be quick and easy to set up a Donor Advised Fund, it is prudent to set it up and have it ready and available to gift at a moment’s notice. Foundations can require time to set up so plan accordingly.

- This is the perfect time to touch base with your CPA, or if you are not satisfied with your current tax advisor, it is a great time to interview a new CPA. Tax professionals see this as a low season, and have the time to engage and discuss your personal situation. Having the proper CPA that can strategize with you and your financial advisor to help reduce current and future tax bills can alleviate a great deal of stress when tax time rolls around.

- Given the changes in Washington DC this year and the continuous conversation around tax changes (such as repealing the Alternative Minimum Tax and eliminating the targeted tax breaks that mainly benefit the wealthiest taxpayers), planning with an eye to the future could mean real money in your pocket. Talk with your financial advisor to make sure you are connected with a tax planner that understands your unique needs.

Key 2017 Annual Limits Relating to Financial Planning

"No Change" means that there were no changes made for 2017 compared to 2016

| Elective deferrals 401(k), 403(b), etc. Catch-up contribution (for age 50+) |

$18,000 (no change) $6,000 (no change) |

| IRA or Roth IRA contribution limit Catch-up contribution (for age 50+) |

$5,500 (no change) $1,000 (no change) |

| SEP IRA contribution maximum Roth IRA phase-out (married filing jointly) |

$54,000 $186,000 - $196,000 |

| Social Security wage base | $127,200 |

| Annual gift tax exclusion | $14,000 (no change) |

| Gift Exclusion to a non-U.S. citizen spouse | $149,000 |

| Estate/Gift/GSTT tax basic exclusion | $5,490,000 |

| Maximum estate tax rate | 40% (no change) |

| Highest marginal fed. income tax rate (39.6%)—Single | $418,400 |

| Highest marginal fed. income tax rate (39.6%)—Married | $470,700 |

| Personal exemption ($4,050) phase-out—Single/Married | starts at $261,500/$313,800 |

| Itemized deduction phase-out (up to 80%)—Single/Married | $264,500/$313,800 |

| Kiddie tax limited standard deduction | $1,050 (no change) |

| Alternative Minimum Tax (AMT) exemption—Single/Married | $54,300/$84,500 |

| Flexible Spending Account | $2,600 |

| For California Residents: CA College Access Tax Credit Fund* | 50% of contributed amount |

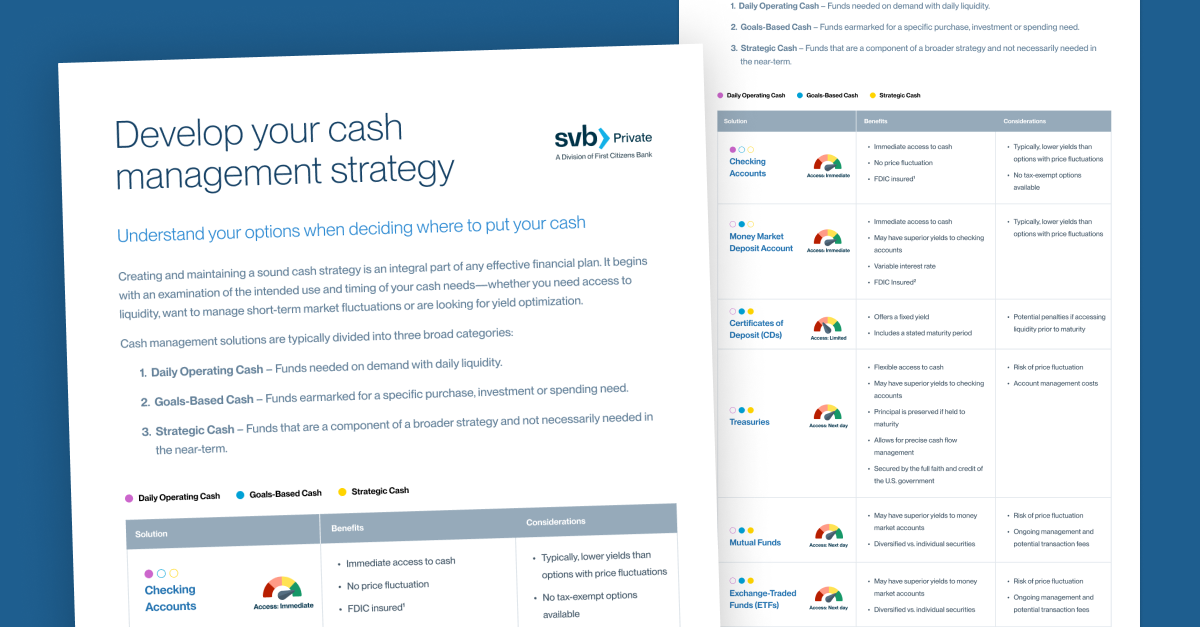

At this stage of the bull market, clients should be reviewing their financial goals and their asset allocations with a financial advisor to make sure that the asset mix is on target and they are still tracking to their goals. We would be happy to work alongside your tax and estate advisors to determine the best approach for you given your individual situation.

The Fine Print

* The College Access Tax Credit (CATC) is a credit available to individuals and business entities that contribute to the CATC Fund in 2017. Sources: Based on current published tax rates from IRS, CCH and College for Financial Planning web sites. Individual tax rates may differ based upon current specific tax situation.