We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

Outcomes, costs, and fiduciary duties top employer concerns

If you haven’t taken an in-depth look recently at how your company’s retirement plan is doing, now might be a good time to check its “vital signs,” especially if your plan is more than 10 years old. According to Brian Lopez, AIF®, CPFA, Managing Director at SVB Private, doing a more thorough analysis of your retirement plan could save you significant costs—and worry.

Lopez and his colleague, Ryan Joyce, AIF®, CPFA, a Director & Retirement Plan Advisor at SVB Private, have advised hundreds of privately-owned emerging businesses and not-for-profit organizations across the U.S. about retirement plan enhancements. And a key part of their team’s work is to analyze all aspects of a company’s plan. “Many of the businesses we’ve worked with have plan providers with fantastic reporting capabilities and vast data points on their plan as well as the plans of similar-size peers / industry,” says Joyce.

Take a deep dive into your data

But what’s often missing, they say, is an individualized analysis of that data based on each organization’s philosophy and goals, and an understanding of how to take action on that analysis. That stands to reason, of course, because a majority of businesses have more immediate concerns to occupy their attention each day. “They don’t have the time or in-house expertise to do the kind of deep-dive analysis that larger corporations do,” says Joyce.

That’s where plan advisors like the ones at SVB Private come in. “What we do is interpret all of that data in light of the organization’s unique business culture and goals, help the owner/plan sponsor understand which aspects of their plan are positive or negative, and then develop an action plan to improve specific areas,” Joyce explains.

Plan sponsors’ top 3 concerns

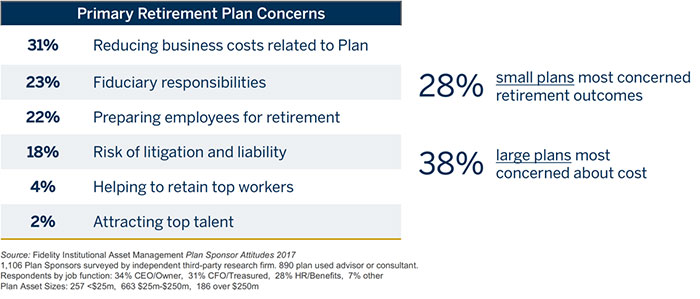

What they’ve discovered through these detailed reviews is that the concerns of plan sponsors from smaller companies are not all that different from the issues faced by sponsors from all businesses. A recent Fidelity survey, for example, suggests that the top three concerns of all plan sponsors across the U.S. are:1

- Reducing costs related to the plan (31%)

- Meeting fiduciary responsibilities (23%)

- Preparing employees for retirement/improving outcomes (22%)

Large plan sponsors (those in the study with more than $250 million in plan assets) were most worried about plan costs (38%) while smaller plan sponsors (with plan assets less than $25 million) were most concerned about their employees’ retirement outcomes (28%).

4 ways to enhance your company’s retirement plan

As a result of their analysis of existing retirement plans, SVB Private’s team recommends enhancements that typically fall into one or more of the categories outlined below.

1. Update the plan’s design and investment line-up

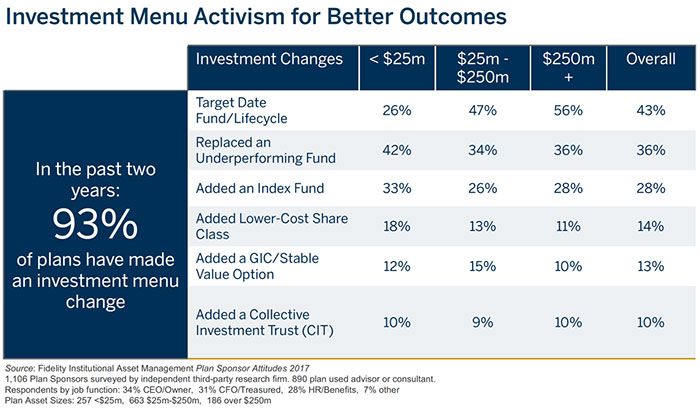

According to the Fidelity study, 93% of plans in the U.S. have made an investment menu change in the past two years, with adding target date or index funds and replacing underperforming funds being top choices.

“Providing participants with an option that allows them to be diversified and becomes more conservative as they get closer to retirement makes sense for many participants,” says Joyce. For those who want to select and manage their own investments, he recommends having more menu choices in the plan and involving an advisor to work with participants as a coach to help them make appropriate investment decisions.

Plan design enhancements that could affect both employer costs and employee engagement include changes to plan eligibility, company match requirements, vesting schedules, and profit-sharing allocations. Running a number of “what if” scenarios to gauge the impact of these changes is essential, says Lopez. “If you’re considering adding a 50% match on up to 6% of each employee’s contribution, for example, it’s easy to do the math and decide whether to go ahead with it based on the cost to the company. A more complete analysis would look at whether that match would have the desired effect of increasing contributions to justify the additional expense.”

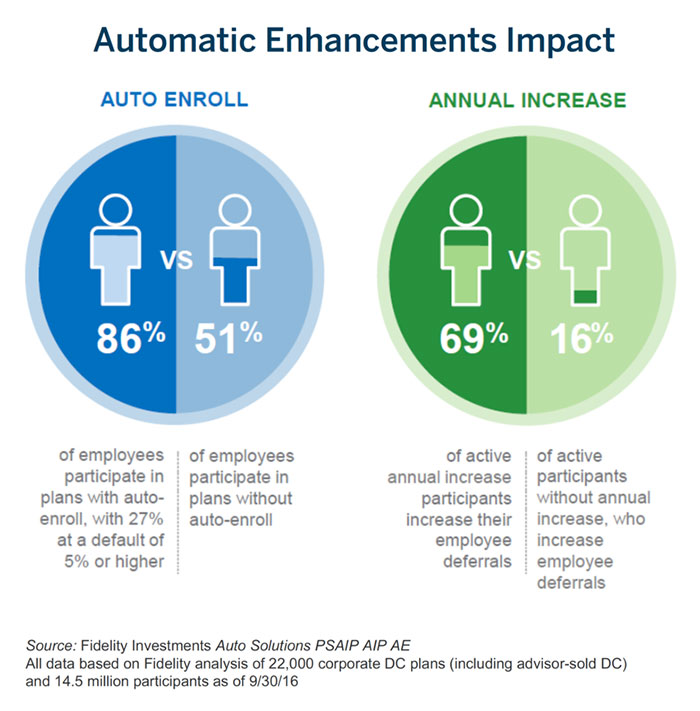

Additionally, updating the plan to include design features such as auto enrollment (with a qualified default investment alternative (QDIA) and automatic increases, can significantly increase employee enrollment and contributions, as shown in the chart at left.

In turn, these changes can:

- Reduce concerns about employees not being “retirement ready” in the future

- Help meet the fiduciary responsibility to act in the best interest of plan participants

2. Fine tune participant education and communications

Some plan sponsors prefer to focus on education and communications to help employees engage in the plan rather than on making structural changes to the plan. They believe more personalized, targeted communications to plan participants can make a big difference in plan participation and utilization.

“Many of the small business and not-for-profit clients we work with are paternalistic,” says Joyce. They value the people who have been with them from the beginning and think of them as family (which in some cases they are). “As a result, even though many of these employers already offer generous retirement plan benefits to their employees, one of their biggest fears is that their employees won’t take advantage of these benefits and have enough income to retire.” They also worry that having an increasing number of employees delay retirement will limit their organization’s ability to hire the next generation of innovators.

To address these issues and drive positive behavior, SVB Private’s team may recommend changes to the plan sponsor’s employee/participant education and communication strategies. If the goal is to improve employee engagement with the plan, they will customize communications based on the frequency, delivery channels, and targeted messaging appropriate for various employee groups.

“Additionally, we work with a plan sponsor to increase employees’ engagement by hosting group and individual meetings with us where they can feel comfortable and confident that our sole purpose is to help them prepare for retirement. We make the conversation simple and to the point. We also try to get each participant to leave the meeting with a clear action step for what to do next,” Lopez explains.

3. Benchmark fees to reduce costs

Because lower fees are key to keeping your retirement plan as cost effective as possible, the SVB Private team looks at plan fees and expenses, and benchmarks them against peer organizations. “We know that the lower the costs of the plan for participants, the more money they’ll be putting to work for their future retirement. So trying to reduce the fees charged by providers and investment managers is a critical element,” stresses Lopez.

Their process for evaluating fees involves:

- Identifying and itemizing all of the costs associated with the retirement plan

- Benchmarking those costs by comparing them with like-size plans and plans in the same industry

- Evaluating areas of higher costs to determine if that extra expense is delivering extra value

- Deciding whether to move to a new vendor

“Determining whether a higher cost is justified can be a bit subjective,” admits Joyce. “That’s when we work with plan sponsors to see if the additional value they are getting from their record keeper, third party administrator (TPA), or investment manager—is worth that higher fee. If it isn’t, then clearly, it’s time to look around.”

4. Meet fiduciary responsibilities

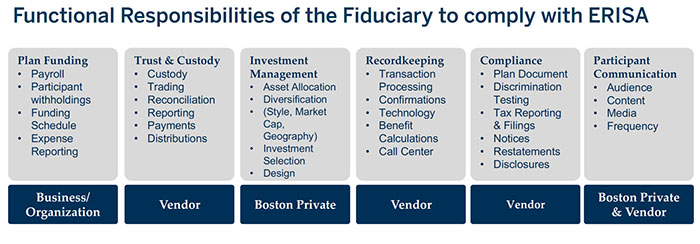

The SVB Private team works with plan sponsors to make sure everyone involved with the retirement plan’s design, upkeep, and communications clearly understands their role in assuring that the plan conforms to the guidelines set forth by the Employee Retirement Income Security Act of 1974 (ERISA).2

Those guidelines require private industry pension plans to protect plan participants by acting solely in their interest (with prudence, skill, and diligence) and by providing them with important information about plan features, funding, and fees. It also outlines the “fiduciary responsibilities” of the people who manage and control a plan’s assets.

The SVB Private team assumes the role of an ERISA § 3(21) fiduciary investment advisor when working with clients. “We partner with the plan sponsor to help them understand what it means to be a plan fiduciary and what regular documentation, reporting, and monitoring that requires. We might explore the roles that must be fulfilled under ERISA and consider which roles might be better fulfilled by sharing, delegating, or outsourcing the responsibilities,” explains Lopez.

By focusing on incremental improvements in the four areas outlined above—plan design and investments, employee education and communication, plan charges and fees, and fiduciary responsibilities—these experts believe business owners and not-for-profit organizations can significantly increase the effectiveness and value of their retirement plans for both the company and its employees.

|

Duties of a Fiduciary according to ERISA

|

“It all comes down to applying best practices so that the plan is outwardly simple to participants, yet inwardly sophisticated to meet the organizations’ objectives,” concludes Joyce.

How SVB Private can help

For more information on how SVB Private’s team of plan advisors can help your organization improve outcomes and reduce costs for your retirement plan, talk to your SVB Private advisor.

1 - Fidelity Institutional Asset Management Plan Sponsor Attitudes 2017