We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

How to grow your team sustainably as your company scales up

If there's one thing a growing business needs, it's great employees. Your company is gaining momentum, which means you need to focus on strategy and operations — not overseeing inventory or managing customer service requests.

To sustain your growth, you'll need to hire employees who can take over some of your tasks and build up key aspects of the business. Hiring can be challenging without an HR department, which is why you must think strategically. Here are some hiring tips to build a strong, growth-oriented team:

Hire an HR specialist

You don't need to staff an entire HR department, but your job will be easier if you bring on someone who is an expert at recruitment, onboarding and overseeing personnel. This person can develop your interview process so you can recruit as efficiently as possible, and they can also serve as the primary contact for issues such as benefits, time off and other employee needs.

Know your legal responsibilities

Whether or not you bring on an HR specialist right away, research your legal obligations. These include state and federal fair hiring and compensation practices, as well as verifying that prospective employees hold the appropriate licenses and certifications for their jobs. You can also reach out to an attorney to consult on these issues.

Scale up slowly

You don't need to fill every open seat at once. Focus on the key roles needed to support the company's growth. Once those team members are in place, you can build out your departments with additional hires. Ideally, the first round of employees will have several competencies so they can cover the gaps until you have the time and funds to bring in additional people.

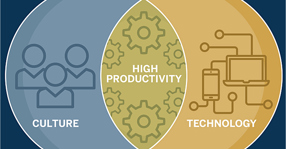

Recruit for culture

Technical abilities matter, particularly when hiring accountants, programmers and others who need specific certifications or skill sets. However, you want to build a team of people whose attributes complement one another and who each support the business's core mission.

The first people you hire will play a significant role in whether your growth strategy succeeds, so you want them to be genuinely invested in the organization's future. Consider whether their personalities and goals enhance the work environment, and whether they're committed to the job. Someone who is interested solely in a paycheck is unlikely to do what it takes to drive your business forward.

Enlist help from an advisor

The average cost of hiring a new employee is $4,129, to say nothing of salary and benefits. An advisor can help you look at your funds and your most urgent hiring needs to maximize your resources and accelerate growth.

Importantly, an advisor can weigh in on your short- and medium-term business plans. Depending on your financial position, you might outline a plan to hire five new employees this year, and 10 the following. You can also review these plans periodically and adjust based on the company's performance. It's critical to find a level between hiring new employees and allocating funds to other essential areas.

The balancing act

Onboarding new employees while maintaining business growth is a challenge. That's why you shouldn't take on too much at once. Hiring a few core people and making sure they're comfortable in their roles stabilizes your workforce and enables you to maintain momentum. From there, you can delegate comfortably and work with your advisors and HR consultant to get hiring tips for your next round of onboarding.

A growing business demands great hires, and a sustainable, strategic process will help you find them.

Working with a SVB Private advisor you can determine how best to use business loans and other funding sources to strategically expand your growing business needs.