We’re pleased to provide you with insights like these from Boston Private. Boston Private is now an SVB company. Together we’re well positioned to offer you the service, understanding, guidance and solutions to help you discover opportunities and build wealth – now and in the future.

Leveraging neuroscience and psychology in your investment approach

There may be nothing across the entire spectrum of human endeavor that makes so many smart people feel so stupid as investing does

Investing is hard. No one is right 100% of the time. Even the most celebrated investors are only right 50-60% of the time. But why is that? What is it about investing that creates such a challenge for people?

At least part of it is explained by that dense connection of billions of neurons between your ears. Your brain.

Over the last handful of decades, there have been fascinating revelations from the fields of neuroscience and psychology. Many of those findings suggest that much of what we’ve been told about investment decision-making is incomplete. Those findings, in addition to many other discoveries, make up the field commonly referred to as behavioral finance.

Losses hurt, a lot

In 1979, Daniel Kahneman and Amos Tversky introduced the concept of loss aversion in their paper Prospect Theory: An Analysis of Decision Under Risk. Loss aversion is your tendency (and mine) to feel financial losses twice as strongly as you experience gains. In other words, losing 10% of your portfolio’s value feels twice as bad as gaining 10% feels good.

Further, you process these losses in the part of your brain called the Amygdala. The Amygdala is the oldest part of your brain in evolutionary terms and is responsible for our “fight or flight” response. So the same portion of your brain responsible for telling you to run from a saber-toothed tiger in the Stone Age is the same part of the brain telling you to hit the panic button in March 2020. It’s hard to take a step back and be completely rational when your Limbic system is telling you that your life is in danger.

Compounding the issue is our natural tendency to shorten our time horizon in times of stress. We are already prone to instant gratification and losing sight of what’s best for us in the long term (referred to as hyperbolic discounting in academic terms). When we are stressed this gets amplified. This focus on near term relief at the expense of a long-term plan can compound the problem.

To put it simply, our brains are ill-equipped to process financial losses as rationally as we’d like to believe.

You’re not as awesome as you think you are

Our cognitive foibles are hard to believe at first. Sure, other folks may fall victim to these decision-making errors, but not me. I’m smart, experienced, and have made plenty of quality investment decisions. We tell ourselves.

The truth is, you are falling victim to overconfidence bias when engaging in this chain of logic. Another bias we are all prone to. This is commonly displayed at investment conferences when a room of 250 attendees is asked to raise their hand if they believe they are an above average driver. 80+% of the room raises their hand, every time. Yet that is statistically unlikely (highly unlikely) to be true.

You are also being duped by self-attribution bias. This is our tendency to take credit for those decisions that have gone well (made money) and spread blame, either on others or the circumstances, for those decisions that go wrong (lost money). This is an ego/self-esteem protection mechanism that, for better or worse, prevents us from seeing ourselves objectively.

The list goes on…

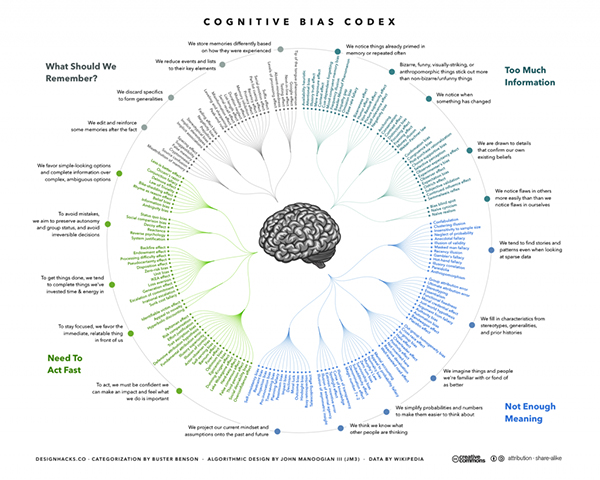

A few years back designhacks.co put together this fantastic visual representation of over 180 cognitive biases. While not all apply equally to the field of investment decision making, it does give a feel for the scope of fallibility when it comes to choosing and deciding.

The antidote

While there are no proven methods to completely eradicate our cognitive biases, there are ways to mitigate them and improve our investment outcomes. Focus on the end goal.

Goals-based investing is one of the best ways to reduce the effects of detrimental cognitive biases. The goals-based approach focuses investors on the appropriate time horizon to mitigate hyperbolic discounting. It also helps screen out our tendency for over-trading, over-complicating, and over-reacting to the market’s short-term gyrations. Additionally, it realigns your reference point away from “beating the market” to progress achieved toward the desired outcome.

While these benefits may sound subtle, or even odd, try not to underestimate them.

At the end of the day, all investors really do, both professional and amateur, is make decisions. They make decisions about what to buy, how much to buy, and when to buy it. If there are flaws in the way those decisions are made, you’d better believe that reducing those mistakes would make a material difference.

Reframing your investment mindset to a goals-based framework is a great step in the right direction.