Reverse positive pay

Reverse positive pay is when clients compare presented checks against what they have issued. Instead of you reporting to us the checks you issue, we report to you the checks that are presented for payment as exceptions for you to review and then tell us to pay or return. Reverse Positive Pay Reports are available in the system to assist you with recognizing mismatched items.

How does it work?

After the Reverse Positive Pay option has been configured on your account, any checks that post to your account will be sent to you by 7:30am ET/4:30am PT as exceptions for review and decisioning. Decisions can be made in Digital Banking on the Positive Pay screen or within the mobile app.

Report options

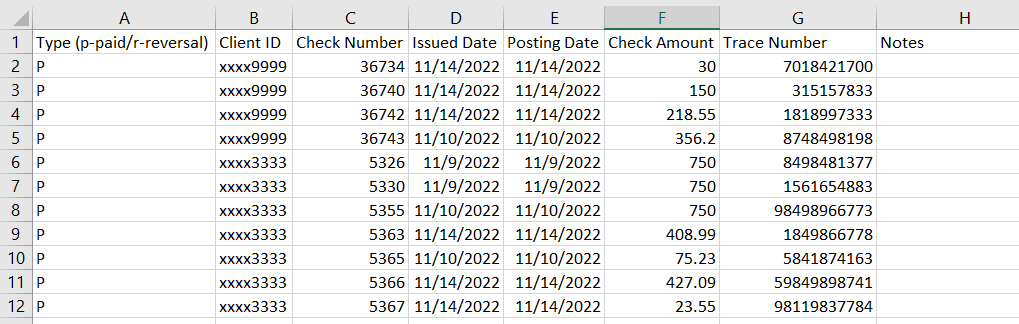

There are two Reverse Positive Pay reports available to assist you in recognizing mismatched items: The Reverse Positive Pay Single Account Transaction Report and The Reverse Positive Pay Multiple Account Transaction Report. They are exportable in .csv format and contain the following fields:

- Check Number

- Client ID (last four digits of the account number)

- Posting Date

- Check Amount

- Trace Number (searchable in Positive Pay)

To create the reports take the following steps:

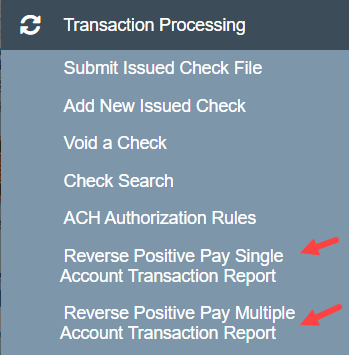

Select the report from the menu under Transaction Reports.

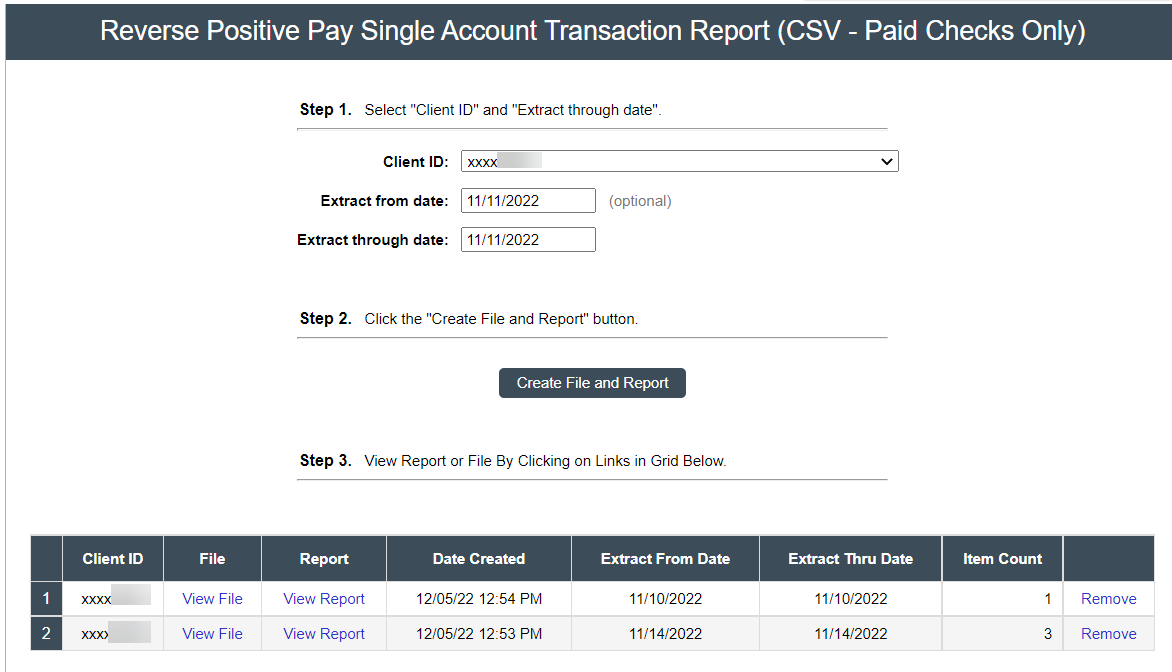

Reverse positive pay single account transaction report

This option creates two reports:

- View Report - a quick view in HTML format

- View File - a downloadable file in .csv format.

This report type allows the transaction date to be extracted once and saves the reports in a grid to be viewed at any time.

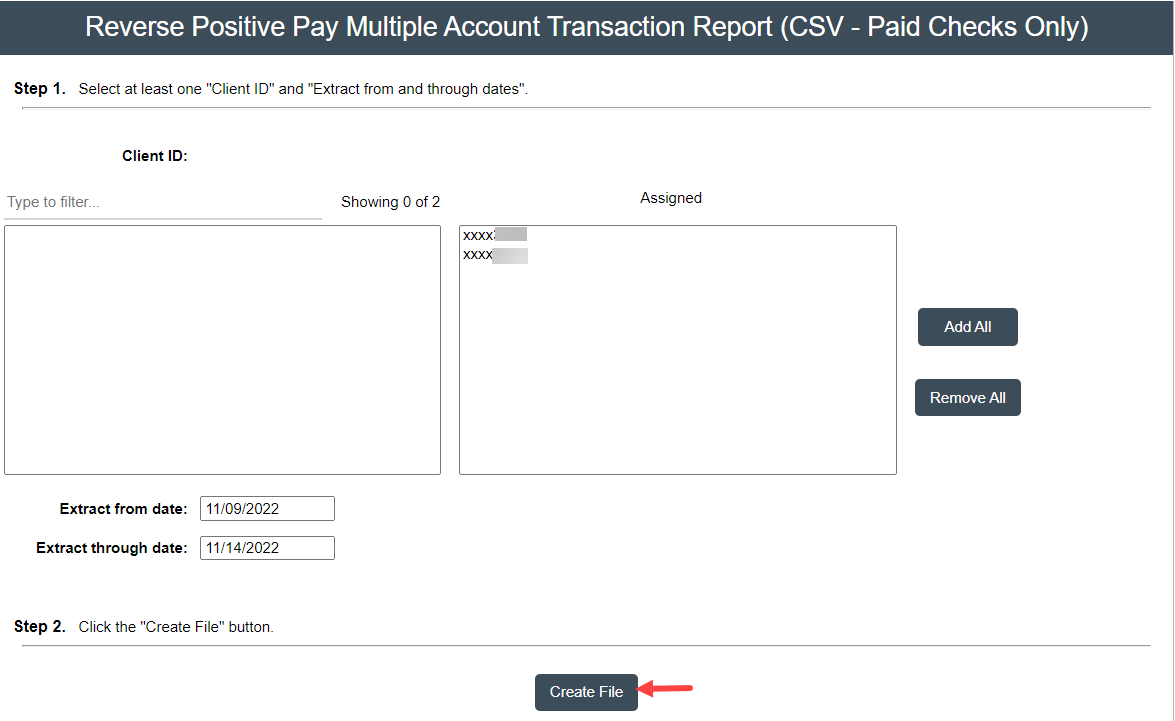

Reverse positive pay multiple account transaction report

This option allows for selection of multiple accounts on one report. This report can be run at any time. The file is created in .csv format.

Below is a sample of the .csv report.

Exception decisioning

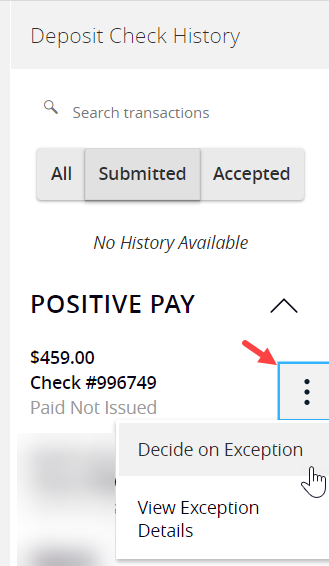

Exception decisions can be made on the mobile app or by signing into Digital Banking. On the Home Screen in Digital Banking, the exceptions will display on the Positive Pay widget on the right side rail. Decisions can be made from the widget as show below:

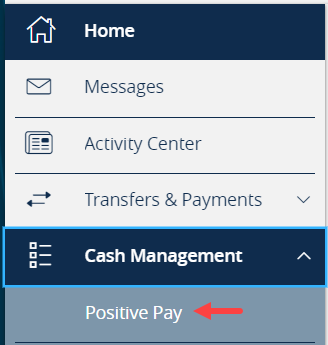

You can also navigate to the Positive Pay screen under the Cash Management menu. Items requiring decision will be displayed here.

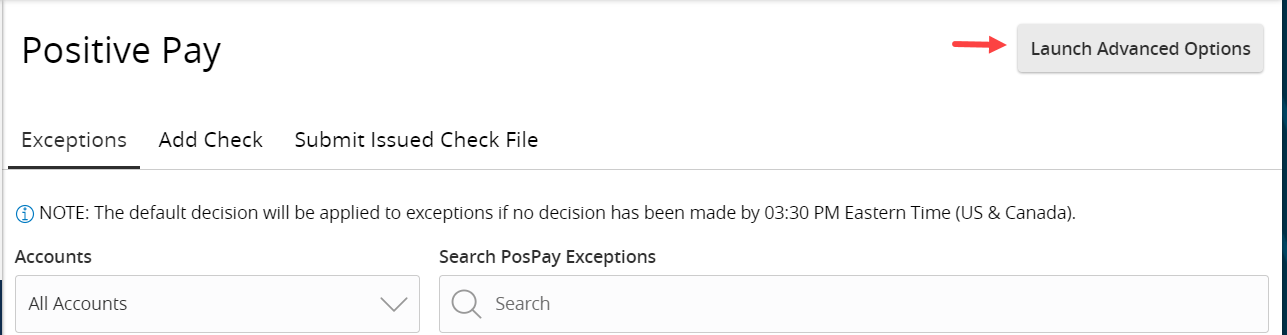

Make decisions within this screen, or Launch Advanced Options to access the Quick Exception Processing screen and view reports within Positive Pay.

Pay or return decisions must be made on exception items by 3:30PM ET/12:30PM PT.

How do I enroll?

To enroll, please contact your local Cash Management Advisor or call the Concierge Desk at 888.322.2120 and ask for a Cash Management support representative