I champion Texas pre-Series A tech founders by aggregating financial resources and building community within the startup ecosystem. Let’s get you ready for your next raise.

Monica Driscoll

Vice President

Startup Banking

Learn More

While our Silicon Valley roots run deep, we’ve been supporting founders and their startups in Austin as it has emerged as a global hub for innovation.

And now we’re deepening our commitment to Austin and expanding our startup banking team to champion your success. Here’s how:

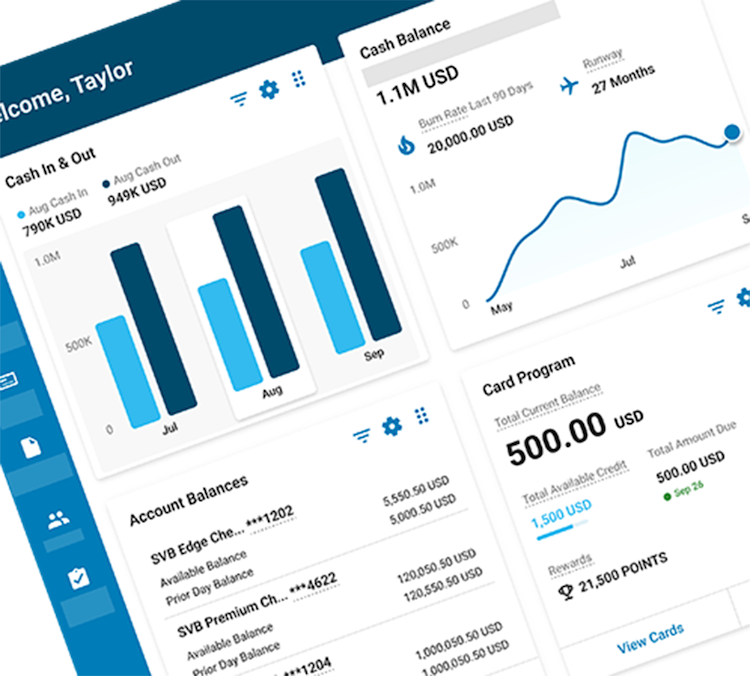

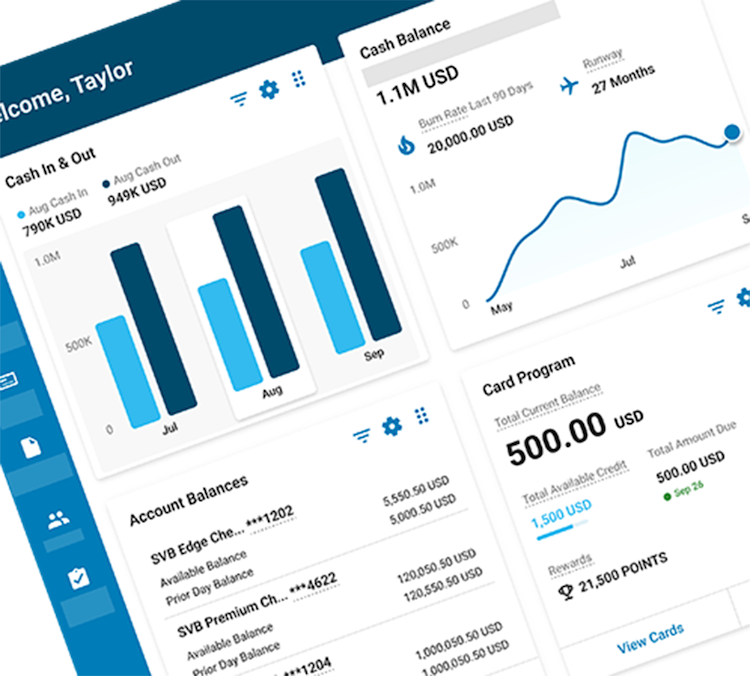

Modern and integrated banking services designed around founders

Founder-first banking offering sector-specific expertise, candid advice and support

Access to our proprietary research and events that bring together founders, investors and others across the innovation ecosystem

Let’s propel you ahead as a true game changer.

Silicon Valley Bank provides products, services and strategic advice to help you turn your big ideas into a great business.

I champion Texas pre-Series A tech founders by aggregating financial resources and building community within the startup ecosystem. Let’s get you ready for your next raise.

Monica Driscoll

Vice President

Startup Banking

Learn More

I lead the bank’s efforts to support the dynamic Central Texas market. I provide guidance, debt capital and banking services to emerging growth companies and entrepreneurs in the innovation economy.

Dax Williamson

Managing Director

Technology Banking

Learn More