Key Takeaways

- Gruesome economic data with surging unemployment doesn’t faze investor risk appetite as stocks soar.

- Central banks pledge “Whatever it takes” as their prescription for recovery.

- Developing markets need help and face an uneven recovery.

What happened?

The global economy stayed home in April: Government mandated shelter-in-place orders brought economies to a standstill worldwide. From Mumbai to Milan and Seattle to Singapore, much of the global economy was told to stay home to prevent the spread and “flatten the curve” of COVID-19. April 2020 may be the worst 30 days of economic activity in history. Over 20 million private sector jobs in the US were lost, erasing all employment gains since the Global Financial Crisis of ’08 - ‘09 as the unemployment rate soared to 14.7%. Each release of economic data reveals the economic reality and devastation the virus has inflicted. Safe-haven currencies remain favorable in the near term as we have no benchmark to measure against and understand how life will change throughout the world.

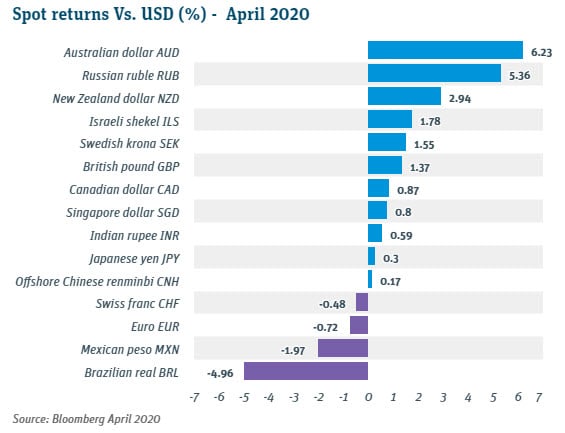

Equity markets are in denial of reality: Quick and resolute action from the Fed to support credit markets and the economy has damped volatility and risk aversion while pushing the S&P 500 up nearly 30% since March 23. The dollar’s rapid rise to the king of safe havens has softened as investors return to risk assets. Developed central banks have adopted a “Whatever it takes” mantra to support the global economy, propelling some currencies, like the British pound and Australian dollar to rebound from multi-decade lows. Continued commitments to this mantra will give safe havens more of a reason to soften when conditions around the world stabilize.

Crude oil goes negative: With the world locked down, demand for oil collapsed. A Russia/Saudi price war increased production adding to an already ample supply. Storage capacity maxed out, causing full oil tankers to sit idle in global ports. This perfect storm of supply and demand ran into the expiry of West Texas Crude futures contracts trading negative on April 20 and 21, reaching -$37.50 per barrel - meaning you had to pay a buyer to take oil off your hands! Commodity currencies like the Canadian dollar, Russian ruble and Norwegian krone only modestly sold-off as much of the crash in oil prices was already priced in. The Indian rupee remained stable during the plunge despite the country being in strict lock down, as India is a major purchaser of oil.

What's in play?

A long, harsh re-opening: As the world reconciles health, safety and the bottom-line, efforts to reopen businesses and restart economies are slowly proceeding. The lights won’t turn on immediately for the whole economy at once, and when they do, work and life will look drastically different. All positive news has been, and will likely be, well received and push the dollar to sell off.

Germany says Nein! to the ECB’s actions: The German Supreme court ruled some of the Quantitative Easing (QE) measures taken by the ECB were unconstitutional. Germans, who are historically inflation hawks, have come down hard on liberal fiscal and monetary accommodations from their eurozone peers in the past. This ruling puts the eurozone’s largest economy at odds with the financier of the programs intended to help those most impacted by the virus and its fallout such as Italy, Spain, and Greece. Instability within the eurozone only adds to negative fundamentals of the euro and can push it closer to parity with the USD over the long run.

Brazil in crises: Justice Minister Sergio Moro stepped down after accusing Brazilian President Jair Bolsonaro of interfering with police investigations. The Brazilian real, already struggling from investors’ global flight to safe-haven assets, depreciated over 30% versus the USD YTD through May 7. Brazil’s Congress also ratified a constitutional amendment to allow the Brazilian Central Bank (BCB) to purchase government bonds, increasing their ability to administer QE. The BCB, who stepped in with aggressive FX swaps to support the real, could see these efforts thwarted by becoming the largest QE program in the emerging markets. With FX reserves at 2011 levels and USD/BRL interest rate differentials near all-time lows, the real has more room to depreciate with 6 BRL per USD in the picture.

What's next?

Chinese Renminbi at 7—ceiling or floor? Chinese/American tensions are rising dangerously fast. The Trump administration doubled down on a theory that the COVID-19 coronavirus originated at the Wuhan Institute of Virology (WIV) rather than from a Wuhan wet market. This attempt to re-shift focus back to the origin of the virus could blow-up months of trade negotiations and a partial deal reached in January. Ongoing strife and worsening relations between the two powers will keep risk sentiment skewed towards the USD, favoring 7 as a new floor for the RMB.

Too much monetary stimulus? Collapses in government revenues and surges in unemployment benefits have been funded in large part through enormous central bank QE programs. This monetary support has increased liquidity and may put future inflationary pressure on those currencies who’ve seen major QE. Currencies of countries which managed to avoid the worst in loss of life and economic wellbeing - without engaging in massive QE and maintaining FX reserves - will have tailwinds to outperform when life returns to “normal”. Look for the Thai bhat and Swiss franc to outperform.

Developing market economies need rescues their governments can’t provide – Developing markets’ economies are not immune from COVID-19 and feel the negative impacts of mandated lockdowns, just as their developed peers. However, with less financial market acceptance to absorb their deficit spending, developing markets’ fiscal and monetary policy remedies are limited. The International Monetary Fund has historically stepped in for support, yet with most of the globe in need they are limited in their options. Over the long term, foreign aid may shift more from US/USD based to Chinese funded and see the renminbi step up as a global reserve currency. Developing market currencies will continue to see pockets of stress, some more than others, as recoveries will drastically vary.