Key Takeaways

- The USD sell-off takes a breather

- Fed shifts policy to “Average inflation targeting of 2%”

- Currency wars are on the horizon

What happened?

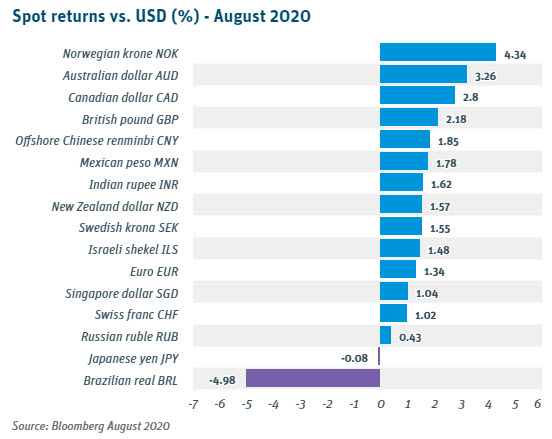

USD falls for the 5th consecutive month: The US dollar’s bear market continued in August as the all-times highs we saw in late March are a thing of the past. The market is overwhelmingly short USD as a Fed-fueled risk-on rally has lifted US equities while the dollar’s interest rate advantage has evaporated. US economic data has given mixed signals of an economic recovery as COVID flare-ups have continued around the country. Look for the dollar to continue to drift lower after the FOMC meeting on the 16th and heading into the November election.

Fed shifts course allowing inflation to run hot: During the Fed’s August Jackson Hole “Zoom” conference, Jerome Powell shifted the Fed’s inflation policy to target an average of 2.0%. Since 2010, US inflation has averaged 1.7%, regularly undershooting it’s 2% target1. The new dovish policy will allow inflation to run higher before causing alarm to the Fed. In order to see sustained price increases above 2%, the Fed’s policy will need to loosen further. Higher inflation should be a net-negative for the US dollar over the medium to long term.

Shinzo Abe steps down as Japanese PM: Citing chronic illness, Japan’s longest-termed Prime Minister resigned after leading the government for eight years. His legacy to break deflation through massive fiscal spending and monetary expansion coined “Abenomics” improved the Japanese economy, logging a record 71-month recovery, but didn’t meet all its goals, such as inflation of 2%2. Abe’s successor will have challenges in a post-COVID Japan with an aging demographic and a stronger yen approaching 100 per dollar.

What's in play?

Technical resistances levels form: Markets are psychological animals by nature and love to reference round numbers to form technical levels for support and resistance. With the dollar’s quick decline, we’ve seen significant support levels form, which may act as barometers for further USD declines - or a reversal if the dollar can bounce off or push through. EUR/USD – 1.20, USD/CAD: 1.30, USD/JPY: 105, GBP/USD : 1.35, AUD/USD: 0.74

Asian emerging market currencies quietly rebound: While the euro and other G10 currencies have seen significant rallies over the last few months, emerging markets lagged, until picking up in late June with an accelerated global risk-on rally. We’ve seen the Indian rupee jump 2% in the last 2 months as strong foreign inflows haven’t been met with any intervention to weaken the rupee from the RBI. The Chinese renminbi has steadily rallied over 3% since June breaking below 6.9, despite saber rattling around trade and a burgeoning tech cold war which includes the sale of TikTok’s US business. The currencies of the Philippines and Korea have also seen rallies of over 5% and 6% respectively since the lows of late March. Developed market’s low interest rates should continue to add lift to EM currencies as investors search for yield.

The UK charges ahead with Brexit before year end: Boris Johnson’s conservative government has backtracked on its original withdrawal agreement signed in January, threatening to blow up final trade negotiations before the UK leaves the EU on December 31. The EU gave Johnson until the end of September to scrap his amendments to the UK’s Internal Market Bill, specifically how a customs border would be drawn in the Irish Sea. The pound reversed its run up to 1.35 back to June lows of 1.27 as a new layer of complexity is added to the currency. With members of his own party skeptical of this political moves, look for Johnson to alter to his demands to allow for trade talks to continue and the pound to make up some losses.

What's next?

Currency Wars are about to erupt, with the losing currency as the winner: A currency war occurs when policy makers, typically central banks, take measures that ultimately weaken a local currency in FX markets in order to boost exports. Whether explicit or not, these policies are bazookas fired to weaken local currencies, often times through expansive monetary and fiscal policy. The Fed fired the first shot in this crisis as well as in the Global Financial Crisis. Look for other developed economies like Canada, Australia and the UK to follow suit, with emerging market currencies strengthening as they have less room for these tit-for-tat measures.

Economic data comes back into focus: For the last 5 years, central bank interest rate policy was the major focus of FX traders. Market expectations of policy changes were carefully watched and decisively moved FX rates. Now, with rate expectations at zero for the next several years, economic data will rise again in significance as traders digest the evolving economic recovery to validate market sentiment and positioning. Expect FX volatility to increase on key economic release dates and to relatively subside around central bank meetings compared to years past.

A contested US election is ahead: With less than 2 months until the US election, markets have priced in much of the election risk with Joe Biden leading in the polls. Even so, we learned from the 2016 Brexit and US Presidential election results that poll numbers aren’t a tell-all and should be taken with a grain of salt. One outcome which appears likely is a contested result, from either party but especially the Republicans. The possibility of mail-in voting leading to delayed or contested results would bring huge downside risk for the dollar as it shows political instability for the safe-haven greenback.

Please feel free to reach out to your SVB Foreign Exchange Advisor for a deeper discussion about the markets, what impact they may have on your firm, and ways to mitigate risk.

1 Bloomberg 2020

2 economist.com/leaders/2020/09/03/abe-shinzos-legacy-is-more-impressive-than-his-muted-exit-suggests