On December 22, 2017, the Tax Cuts and Jobs Act was signed into law and introduced IRC Section 83(i) that could enable eligible employees to defer federal tax obligations on eligible stock from equity grants from eligible companies.

Section 83(i) and its predecessor, Empowering Employees through Stock Ownership Act (EESO), is aimed at addressing the employee’s dilemma of holding stock options in rapidly growing startups without the financial means to exercise and pay the applicable taxes. Employees caught in this decision often feel handcuffed to the company since they would be required to exercise their grants within a short time frame of leaving the firm, but do not have the financial resources to exercise and pay the applicable tax withholding. By not exercising, many grant holders leave hundreds of thousands of dollars in the balance.

This article will provide founders, executives and board members of private companies with an overview of IRC Section 83(i) and some things they should consider either before implementing an 83(i) compliant plan or in the event an employee asks about making an 83(i) election on their current grant(s). As always, you should consult with a tax advisor regarding your specific situation.

Understanding Section 83(i).

IRC Section 83(i) allows employees to defer federal taxes due on eligible grants for up to 5 years or until a disqualifying event, whichever comes first. The income from the deferral must be included in the taxable year of the disqualifying event or the lapse of the 5 years.

A disqualifying event is when:

- the first date the stock becomes transferrable (including to the company)

- the first date the stock becomes readily tradable on an established securities exchange

- the date the employee first becomes an “ineligible employee” (see below)

- the date on which the employee revokes the election

Only eligible companies may offer the deferment option.

Start-up and early stage companies depend on equity-based compensation to attract and retain talent. The deferral of income tax recognition following the exercise of stock options or vesting of restricted stock units (RSUs) can be a valuable benefit to employees who may not otherwise have the funds available to pay the taxes at that time. To offer this benefit your company has to qualify.1

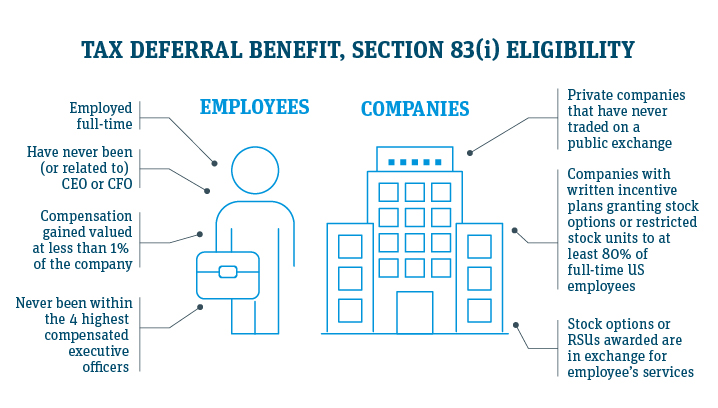

Under Section 83(i), your company is generally eligible if:

- the corporation’s stock does not trade (and has not traded during any preceding calendar year) on a public securities exchange and;

- it has a written plan in place under which, in the applicable calendar year, at least 80% of US qualified employees received grants

- the stock options or RSUs you award (excepting a combination of the two) are in exchange for your employees’ services and must have equal rights and privileges to receive qualified stock.

Employees are eligible if they:

- are employed full-time;

- are not (and have never been) the CEO or CFO and they are not related to your CEO or CFO;

- are not a 1% owner of the company during the calendar year, and have not been a 1% owner at any time during the preceding 10 calendar years (this includes equity compensation), or a related party to such owner; and,

- have not been one of the four highest compensated officers during the current year or preceding 10 taxable years.

Stock is only eligible for the election if:

- stock was received from an option exercise or settlement of an RSU; and

- stock cannot be readily saleable (or that the employee could otherwise receive cash in lieu of the stock)

Companies are required to have a written plan.

83(i) mandates companies document that in each calendar year, no less than 80% of US (or US possession) full-time employees are granted stock options or RSUs, with the same rights and privileges to receive qualified stock. This may be a difficult hurdle for companies that are not doing standard refresher grants for their employees.

The 80% requirement applies separately to RSUs and options and the code defines the determination of rights and privileges to be similar as the manner described in section 423(b)(5). Companies should seek legal clarity regarding these matters.

Since your existing incentive stock plans do not have language surrounding 83(i), you would have to amend any existing plan in order to comply. Tom Bondi of Armanino, LLP believes “…while existing plans could possibly be amended to include such language, companies should consider shrinking the size of the existing available pool and creating a new 2018 plan that contains the language instead.” This would give the company more flexibility on giving grants that are unique.

Companies are required to notify employees.

Section 83(i) requires the company to provide notice to their eligible employees at the time (or a reasonable period before) they become eligible to make an 83(i) election. In addition, the company needs to certify that such stock is qualified stock and inform eligible employees as to the tax impact of making the election and disclose certain tax risks and consequences associated with making the election.

An election to defer income must be made by the employee no later than 30 days after the first time the employee’s right to the stock is transferable or are not subject to substantial risk of forfeiture, whichever occurs earlier. This generally means the election must be made within 30 days of the issuance of stock following exercise of a stock option or stock settlement of an RSU.

Expect added withholding and reporting obligations.

Nonqualified stock options (NQOs) and restricted stock units (RSUs) each present different withholding and reporting obligations. Typically, if an employee exercises an ISO and makes an 83(i) election, the ISO will automatically convert to a NQO and applicable withholding and reporting applies. When employees make an 83(i) election, the federal tax reporting and withholding obligations are deferred. However, state (state tax laws vary and some may be conforming to federal tax law), social security (FICA) and medicare withholding are still applicable.

For example: If your eligible employee makes an 83(i) election on an ISO, the underlying option will convert to a NQO. As such, at the time of an NQO exercise, you will report the income attached to the exercise, withhold for FICA, medicare and any applicable state tax, and track the appropriate withholding amount for federal taxes. At the time of a disqualifying event, your company will have to remit the deferred Federal and any applicable State tax on the deferred income. Setting up procedures to track payments from participating employees (and potentially ‘ex-employees’) may become complicated. Tom Bondi of Armanino LLC suggests “…companies should plan for time and resources to accommodate these reporting requirements.”

For example: You grant an employee an ISO for 4,000 shares. At the end of the first year the employee chooses to exercise the option and buys 1,000 shares without making an 83(i) election. Then, at the end of the second year the same employee exercises the option to buy a second lot of 1,000 shares, but this time chooses to defer tax with an 83(i) election. The second exercise of 1,000 shares will now need to be treated as an NQ option grant for record keeping, tax reporting and withholding; therefore, you may expect to have to make manual work arounds, similar to those made on grants exceeding the ISO $100,000 limitations.

You should be prepared to provide further education to eligible employees to ensure they understand the difference and impact an 83(i) election can make to their tax situation. Educating employees may help them avoid making short-term decisions regarding the financial planning surrounding stock option exercises.

Company stock repurchases can disqualify employees.

The new tax law restricts your employees from making an 83(i) election if your company has repurchased any of your outstanding stock in the prior year, unless at least 25% of the total amount of repurchased stock was previously deferred by your employees under the section. The law is unclear if this applies to your company’s right of first refusal (ROFR) on unvested shares. Companies should consult with an attorney and tax advisor to consider how this may impact any repurchases given the current activity in the secondary markets.

An 83(i) election has risks employees should know about.

Deferment of income taxes can be a powerful enhancement to your compensation offering, as an 83(i) election can enable your eligible employees to take advantage of options you award without the pressure of immediate tax implications. No matter how the stock performs, your employee would still be obligated to pay any required withholding obligations, including the deferred taxes. Since the taxable amount is fixed according to the fair market value of the stock when the election was made, they could suffer a capital loss if the stock goes down in value after the election. Also, they could find that the tax is due but the shares are still illiquid as is the case of a company going public (taxes are due at the time of the IPO) but the shares are subject to a lockup agreement.

Next steps? Carefully consider benefit, risks and obligations.

In addition to the elements described above, there are certainly many things that companies should consider before offering this program to employees. Providing this “benefit” to employees may in fact be a risk that backfires in unpleasant ways for the company and the employee. Companies should begin to educate themselves on Section 83(i) and engage with appropriate experts in advance of employees asking about it. They should be prepared with how to handle an employee making the election without consulting with the company first and delivering the notice to the employer.

We are happy to have a conversation with you to review the pros and cons of 83(i).

About Tom Bondi, Tax Partner, Armanino LLP:

Tom works with early stage technology companies, providing full service consulting and advisory services. As an advisory board member for client companies, he takes a lead role in the positioning of companies during stages from seed funding through merger and acquisition. Tom was a co-founder of a software development company and Chief Financial Officer from its start-up to its acquisition. He also worked in product management for a major Silicon Valley semiconductor manufacturer before entering public accounting. He has served as a board member of many nonprofit organizations and political committees, and has worked extensively in success planning for closely held businesses, stock option planning, interim-CFO services, and estate and trust planning. Tom is a member of the California Society of CPAs and American Institute of CPAs. He has been an advisory board member of many companies and has managed strategic relationships with Silicon Valley accelerators. Tom received his Bachelor of Science in Finance from Santa Clara University.

1An 83(i) deferral is not available for equity awards granted by LLCs taxed as partnerships for federal tax purposes.