Key Takeaways

- Investors embrace a split US election outcome.

- Covid-19’s second wave in Europe has led to new lockdowns.

- Near-term stressors spur demand for US dollar, but the dollar is expected to weaken over the long term.

The month of October has a reputation in financial markets for being more volatile than any other month of the year. It did not disappoint this time, providing an extraordinary mix of potentially game-changing events. Investors were faced with the upcoming US Presidential and Congressional elections, a fast advancing Covid-19 second wave, an approaching deadline for EU-UK Brexit trade talks, and a highly uncertain corporate earnings season.

What Happened?

Joe Biden won

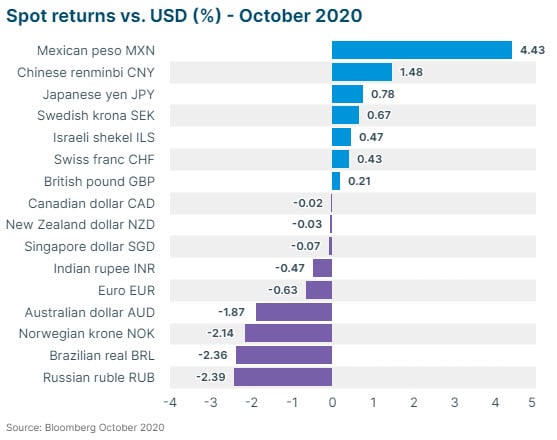

Now that the election is over, the resulting blue Presidency and red Senate is leading investors to embrace a new best-case scenario for risk assets: a government less willing to raise taxes, less likely to tighten regulations on corporate America, and more likely to get along with foreign allies and China. A newly energized risk-on mood in the markets is driving equities higher, increasing demand for foreign assets and currencies, and reducing demand for the US dollar.

Dollar fell to 2½ year low

The Bloomberg Dollar Spot Index (BBDXY), which tracks the dollar’s value against a basket of 10 currencies, has dropped to its lowest level since February 20181. Main drivers of the drop are new “risk-on” possibilities in financial markets and low short- and long-term US interest rates:

-

Lower short-term rates – the Fed said it will “keep rates near zero until there is material improvement in unemployment and higher inflation;"2 and,

-

Lower long-term rates – expectations of a large fiscal stimulus package led investors to position for future higher bond yields. When the Senate remained red, which will most likely lead to a smaller stimulus package, investors quickly scaled back positions, pushing yields lower.

Tech sector earnings soared

Big tech companies profiting during the pandemic reported strong Q3 earnings, reflecting how people all over the world have increased their usage of the big internet firms’ services. The equity market’s initial response to the election outcome was to bid up tech stocks. In an article in this weekend’s Barron’s, US Bank Wealth Management Chief Equity Strategist Terry Sandven said, “We believe the longer-term secular growth trends of the sector are intact and will drive higher in 2021,” adding, “Technology is the new defensive sector, with tentacles that extend well beyond the election outcome and current Covid-19 pandemic.”

What’s at Play?

Europe suffers second wave

Europe is seeing a surge of Covid-19 infections and hospitalizations, leading many EU member nations to reimpose lockdowns. In fact, beginning last Thursday, England announced its 56 million people will have to endure a nationwide lockdown—its second in seven months.3 As a result, Paolo Gentiloni, EU Economy Commissioner, said, “Growth will stall in the fourth quarter and pick up in the first part of 2021, but it will be two years before the EU economy comes close to regaining its pre-pandemic level.” 4

G-10 central banks increase quantitative easing

The Federal Reserve, Bank of England, European Central Bank and Reserve Bank of Australia announced they will be increasing their respective quantitative easing efforts to bolster economic recovery. Central bank ability to respond to Covid-19 is becoming more limited. As Fed Chair Powell has indicated, we will increasingly have to rely on fiscal stimulus until a vaccine is available.

What’s Next?

US negotiates stimulus packages

Senate Majority leader Mitch McConnell mentioned that a monetary stimulus package should be passed by the end of the year, but the $500 billion proposed by Senate Republicans has been deemed unacceptable by Democrats.5 Further, as a result of a divided congress, the Fed is expected to be further pressured and a smaller fiscal stimulus package may result. In any event, as the pandemic and the economy worsen, further stimulus packages could pass in short order.

China expected to outperform

China is the only big economy expected to show positive growth this year. The IMF is projecting growth of 1.9% for 2020, followed by a projected growth of 8.2% in 2021.6 After the 2007/2008 financial crisis, the US benefited following China’s huge fiscal and monetary stimulus. Today, as a result of continued trade friction between the US and China, the US may not benefit from the current expansion.

Australia to reduce dependence on China trade

China imposed new tariffs on Australian barley, beef and wine exports following Australia’s demand in April for an inquiry into the origins of the Covid-19 outbreak.7 The Australian government since has advised Australian businesses to seek new export markets and reduce their dependence on China.

The US dollar expected to weaken further

Over the near term, there is potential for increased market stress related to Covid-19 and ongoing legal challenges to the US presidential election—both may increase demand for the safe-haven dollar. Nevertheless, we remain bearish on the US dollar over the longer-term:

-

It is likely the Fed will remain overly dovish to counter weak economic growth and low inflation. Real rates will remain relatively low, which will weigh on the dollar and generally support investors’ risk-on appetite, further reducing demand for, and weakening dollar.

-

Many investors are already looking beyond Covid-19. In fact, of this writing, Pfizer announced its vaccine is 90% effective, with further vaccine developments anticipated to better synchronize global economic recovery and increase demand for risk assets, global equities and foreign currencies.

-

If the US yield curve continues to steepen (as we think it will), European investors in US Treasuries will earn yield-pickup over local bonds even after hedging their US dollar exposure (selling USD forwards becomes attractive).

-

Multiple types of technical charts of the US dollar point to a multi-year decline in the dollar.

For more analysis on FX markets or information regarding SVB's FX services:

Contact your SVB FX Advisor or the SVB FX Advisory Team at fxadvisors@svb.com.

See all of SVB's latest FX information and commentary at www.svb.com/trends-insights/foreign-exchange-advisory