Key Takeaways

- A “K-shaped” economic recovery illustrates how different parts of the economy have recovered at different rates, times, or magnitudes.

- Investors are putting on “reflation trades,” which favor assets that will benefit from rising economic growth and inflation, and limit exposure to long-term bonds.

- A seldom used Fed tool and an unconventional economic theory may help reflate the economy.

- An end to the US dollar’s “exorbitant privilege” may be fast approaching, as other currencies gain value.

Here are five terms that increasingly matter to the markets. This explains what they signify and what impact, if any, they may have on the value of the US dollar.

1. “K-Shaped” economic recovery

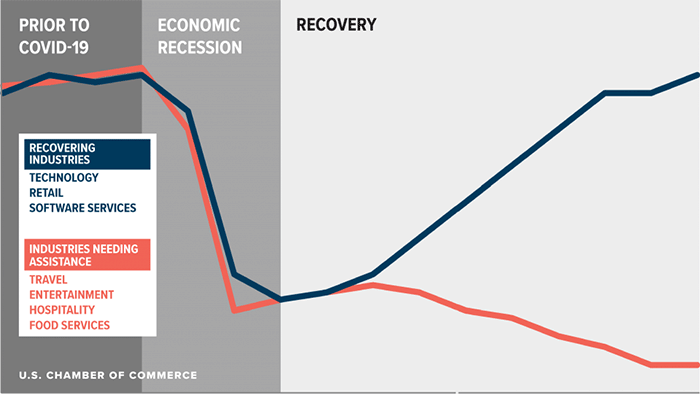

A “K-shaped” recovery occurs when, following a recession, different parts of the economy recover at different rates, times, or magnitudes.

-

A K-shaped recovery contrasts with other letter-shaped illustrations of economic recessions and recoveries (L-shaped, V-shaped, U-shaped, or W-shaped), which all show a single path of an economy-wide, macroeconomic, aggregate economic variable, like GDP.

-

K-shaped recovery example (see chart below): after the economic recession in Q2, there was a K-shaped divergence in performances between industries: 1) Tech, Retail and Software Service, which recovered quickly; and 2) Travel, Entertainment, Hospitality and Food Services, which declined.1

-

Impact on the US dollar: the unparalleled success in the technology sector, in particular, has helped support the never-ending, incredible rally in global stocks, and investments into other ‘risky assets’ (even Bitcoin soared!), while at the same time reducing demand for the safe haven US dollar.

2. The “reflation trade”

Reflation trades favor assets likely to benefit from rising economic growth and inflation; such as cyclical growth stocks, whose performance is directly tied to the performance of the overall economy (e.g., car manufacturers, airlines, restaurants), and emerging markets assets, while limiting exposure to long-term government bonds.

-

Pre-election, investors feared a return of inflation: prior to the election, investors were putting on reflation trades as a bet on a “blue wave” of Democratic victories for the presidency and Senate, an outcome that would lead to massive, reflationary fiscal spending to help stimulate economic output, but which would probably trigger inflation.

-

Post-election relief: the reflation trade all but disappeared when it became apparent that Republicans would likely retain control of the Senate, thereby reducing expectations for a fiscal reflationary package in the trillions to a “skinny” package in the hundreds of billions. Government bond yields quickly plummeted and stocks were mixed – Tech stocks soared, as the prospect of rates lower for longer would support their high valuations, and at the same time, firms dependent on faster economic recovery, the cyclicals, trailed.

-

The “reflation trade” may not be dead, just delayed: with no clear winner in two Georgia senate races, the stage is set for runoff elections on January 5. This puts the reflation trade back on the table, although current odds for two Blue wins are not overwhelming.2

-

Impact on the US dollar: investors increasingly see reflation in 2021, which will be characterized by global economic growth, steepening global yield curves, and ‘risk-on’ investor sentiment. With that scenario, expect an increase in demand/rising prices for ‘risky’ stocks (foreign to outperform overvalued US stocks), commodities, foreign currencies, and lower demand for the US dollar.

3. Yield curve control (YCC)

This Fed policy tool targets a specific level of Treasury yield, then pledges to buy enough long-term bonds to keep yields from rising above that level.3

-

The Federal Reserve has already done a yeoman’s job of supporting the economy and the global financial system during the Covid-19 crisis. It reduced interest rates to near zero and effectively used two other tools – ‘forward guidance’ to influence markets and quantitative easing (QE) to increase money supply and encourage lending. But what if it needs to do more? Yes, Fed officials have discussed yield curve control.

-

Two other central banks currently use YCC: The Bank of Japan introduced its YCC in September 2016, capping yields on 10-yr JGBs at around zero percent; and, the Reserve Bank of Australia in March 2020 began capping yields on 3-yr government bonds at 0.25%.4

-

Impact on the US dollar: capping bond yields means rates remain lower for longer than they would be without the caps, which could limit the appeal of US Treasuries to overseas investors. Also, restrictions on US yields could push domestic investors to foreign markets in search of yield, income and capital gains. Both scenarios would reduce demand for the dollar.

4. Modern Monetary Theory (MMT)

A new, unconventional economic theory, MMT, proposes that a government that controls its own [fiat] currency can spend freely, as they can always create (print) more money to pay off the debts in their own currency.5 This implies that budget deficits are irrelevant.

-

MMT has become the economic theory of the progressive left: MMT proponents argue that the US can run never-ending budget deficits and accumulate spiraling debt, as long as it doesn’t lead to inflation. Traditional thinking says such spending would be fiscally irresponsible as government debt swells and inflation soars.

-

The economic crisis isn’t over: interest rates are already at zero and government debt levels are at record highs, so solving the crisis will require more complex and creative means to reflate the economy.

-

Impact on the US dollar: governments need to close the gap between spending and tax receipts, a situation worsened by Covid-19. MMT says governments and central banks should print more money to fill that gap. Since the United States may currently be in the most challenging position in the developed world, the US dollar might suffer if MMT is implemented here and then the idea behind the theory is wrong.

5. US dollar’s “exorbitant privilege"

It is argued that the US is taking advantage of its privileged position as the world’s most dominant reserve currency, enabling it to draw freely on the rest of the world to support its over-extended standard of living.6 Some predict that the end of the dollar’s “exorbitant privilege” is fast approaching.

-

The US is becoming less dominant economically: over the last two decades, the progress of the eurozone, and more recently, China and India, means that the United States accounts for a smaller share of international transactions. This fact creates uneasy stress with the unique dominance of the US dollar.

-

US budget and current account deficits soaring: in Q2, net domestic savings of households, businesses and government fell into negative territory for the first since 2009. Predictably, the US levered its exorbitant privilege to borrow from abroad, pushing the current account deficit to -3.5% of GDP in Q2, its sharpest quarterly contraction on record.7 With such deficits, foreign lenders may soon start demanding higher interest rates for such massive external financing.

-

China does not wish to dethrone the dollar: China has too much invested in the dollar – it owns an estimated $1.1 trillion in US Treasuries - about 21% of the US debt held overseas.8 But they do want a more significant international role for their own currency. And, where the renminbi leads, other emerging currencies, such as the Indian rupee and Brazilian real, could eventually follow.

-

Impact on the US dollar: the US dollar’s high effective exchange rate makes it the world’s most overvalued major currency.9 The €750 billion pan-European recovery fund will boost the undervalued euro, with the renminbi, gold and even cryptocurrencies gaining as payment and/or investment alternatives to the once unbeatable dollar. The dollar is at risk of a sharp correction.

Please feel free to reach out to your SVB Currency Advisor for a deeper discussion about FX, what impact it may have on your firm, and ways to mitigate risk.