Spot (mid-market) rate = 71.24/USD (10:00 a.m. ET, February 27, 2019)

Summary

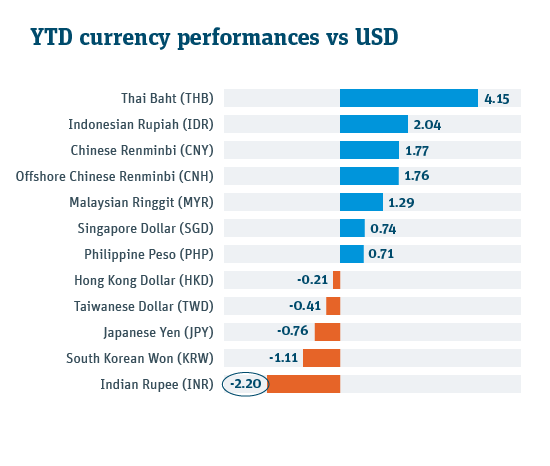

Emerging Market (EM) assets and currencies have benefited from the US Fed’s dovish pivot and the reduced volatility seen across financial markets. However, not all EMs have been treated equally by investors, particularly with a backdrop of declining global growth. India’s capital markets have recently suffered from heavy selling by foreign investors in both equities and bonds, helping drive the Indian rupee lower.

Performance: YTD 2019 the Indian rupee has been the worst performer of the Asian currencies

Primary reasons

Primary reasons

- Uncertainty about India’s general elections in May. Prime Minister Modi’s re-election bid is turning out to be an uphill battle. In a not-so-subtle attempt to win votes, PM Modi just announced a record $100 billion spending plan for their new fiscal year starting in April. Three recent surveys indicate he will not win a majority.

- Rising geopolitical tensions between India and Pakistan. Last week, a deadly attack on India’s security forces in India’s Kashmir state, the disputed region in the Himalayas, was claimed by a Pakistan-based militant group. PM Modi said the nation will give a “befitting reply” to the assault.

- The newly appointed Governor of India’s central bank is a dove. In December, the highly-regarded Governor of the Reserve Bank of India (RBI) resigned amid pressure from the Modi government to loosen monetary policy to stimulate the economy. A more dovish governor was appointed, and he quickly cut interest rates by 25 bps. Traders expect another 25-50 bps cut in April. A storm is brewing now over the RBI’s independence from the government.

- Incredibly shrinking reserves. From a record $426 billion in April, FX reserves have fallen to $398 billion this month, a drop which could hamper the central bank’s ability to defend the rupee in the FX markets.

- Higher oil prices. India is the third largest consumer of oil in the world, after the US and China. Its estimated oil bill is set to reach $125 billion in fiscal year 2019.

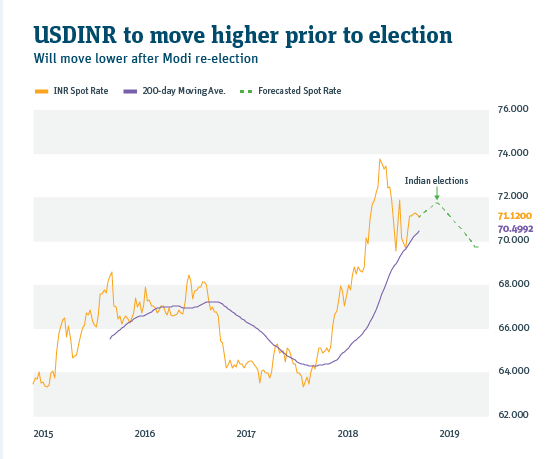

Technicals

Our view

- India remains one of the fastest growing major economies in the world. Despite the fact that year-over-year growth declined in Q3 2018, India’s economy still grew in Q3 by an impressive 7.2 percent.*

- If Modi is re-elected, he will likely continue his progressive tax and bank loan policies, which bode well for corporate earnings growth. However, growth may be impacted by India’s high unemployment rate and “shadow banking sector.” The unemployment rate is at a 35-year high, and India’s “shadow banks” focused on consumer lending are deeply under water.*

- It’s likely that Modi will be re-elected, but that he will not win a majority, so will need to form a coalition government. Nevertheless, I forecast a modestly stronger Indian rupee following the election.

Tactical hedging of INR-denominated expenses: consider using 3-6 month non-deliverable forwards if the USD/INR climbs to 72.00-72.50.

Strategic hedging of INR-denominated expenses should also be considered: our long-term (in the next 1-2 years) view for the US dollar is that it will weaken against all currencies.

Contact us

If you have questions about how the Indian rupee volatility may affect your global business, contact your FX Advisor directly, or email us at fxadvisors@svb.com

Learn more

Read the recent SVB Market Insights and Risk Advisory articles:

- Five themes that matter to FX markets

- Why passive FX management falls short

- How currency movements can affect your global business

- See all our foreign exchange services

*Data source for performance charts and India economic data: Bloomberg 2019 / Reserve Bank of India.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

CompID-022619