Over the last few months, an increasing number of market analysts have claimed that the strong dollar is ready for a reversal because it is overvalued.

Their claim is based on an economic theory called Purchasing Power Parity (PPP). PPP is based on the “Law of One Price”: the cost of a good or basket of goods should be the same in every country, assuming that trade is free of transportation costs and trade barriers. If not, the country with the more expensive goods is thought to have an overvalued currency, which will weaken over time, as undervalued currencies strengthen (towards an “equilibrium of cost” rate).

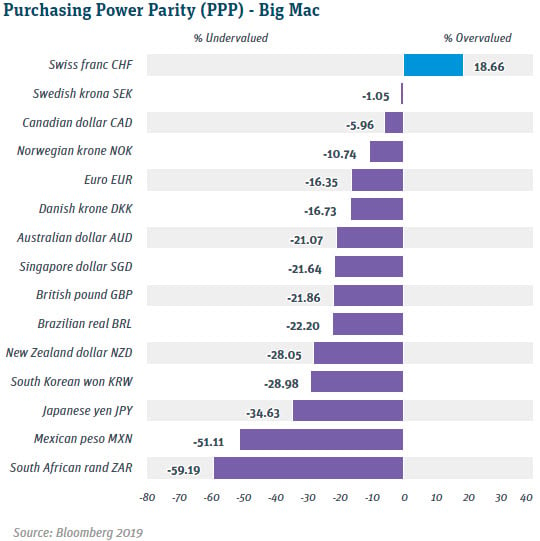

The International Monetary Fund, OECD, World Bank and United Nations have all created complex measures of PPP. The Big Mac Index was created by The Economist and based on the cost of single item – a McDonald’s Big Mac. Here’s the logic – a Big Mac costing $5.00 in NYC should cost 100 pesos in Mexico City, since the current FX rate is about MXN 20/$1. However, a Big Mac costs only 50 pesos in Mexico City. Because of that, the Index states than the peso is undervalued by 50% (see table below). The Big Mac Index has had a surprisingly accurate track record of forecasting currency moves compared to the more complex PPPs.

Here are current Big Mac PPP valuations for fifteen currencies versus the US dollar:

Except for the Swiss franc, all foreign currencies listed are undervalued on a PPP-basis against the USD. By definition then, the dollar is overvalued on a PPP-basis against those currencies, which is why some analysts are taking note.

It is important to mention, however, that the PPP theory has real shortcomings – transportation is not free, and quality of and preference for goods differ from country to country. But a bigger issue makes PPP virtually useless in forecasting currencies over the short to medium term: currencies can remain over or undervalued for long periods of time. The Japanese yen has been undervalued versus the dollar by at least 10% for the last five years, and the Swiss franc has been overvalued versus the dollar by more than 15% for decades! As such, most FX professionals, including me, consider PPP a minor data point when forecasting currency rates.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.