Summary

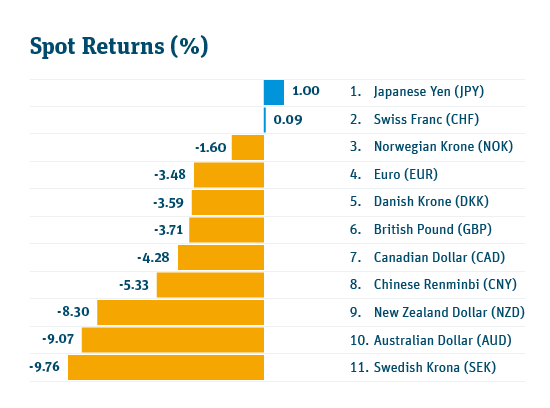

The Australian dollar has been one of the weakest of the major currencies this year, down 9.07 percent versus the USD and 6.8 percent on a trade-weighted basis.

AUD decline can be attributed to several factors

- UNATTRACTIVE INTEREST RATES: USD short- and long-term interest rates crossed higher than comparable AUD rates early this year. Historically, AUD rates are always higher, helping make it the perennial favorite G10 currency for parking excess cash… until now.

- POLITICAL INSTABILITY: On August 24, Australia’s Prime Minister Turnbull was ousted after his support collapsed within his center-right Liberal Party. He was replaced by former national treasurer (and more business-friendly) Scott Morrison. Not one prime minister has completed a three-year term since 2007, so expect an election sooner rather than later.

- KEY TRADING PARTNER CHINA: Australia’s trade with China dwarfs trade with all other countries. China’s decelerating economy and trade war with the US do not bode well for Australia’s economy. The weakening Chinese yuan since June has put pressure on the AUD, since these currencies typically move in the same direction.

- SOFT COMMODITY PRICES: Prices of metals important to Australia, iron ore, nickel, copper, and gold have been declining since mid-May.

There are some compelling reasons to be supportive of the AUD

- STRONG ECONOMY: Australia is benefiting from strong economic growth and record jobs creation. The country has not suffered a recession in almost three decades. The weaker AUD is certainly providing a boost for Aussie exporters.

- SPECULATORS POSITIONED EXCESSIVELY SHORT AUD: According to CFTC reports, currency speculators, as a group, have the largest net short AUD position since late 2015. I consider this an overcrowded position, which means it should be difficult for AUD to be pushed much lower from here without a correction first.

Technical analysis

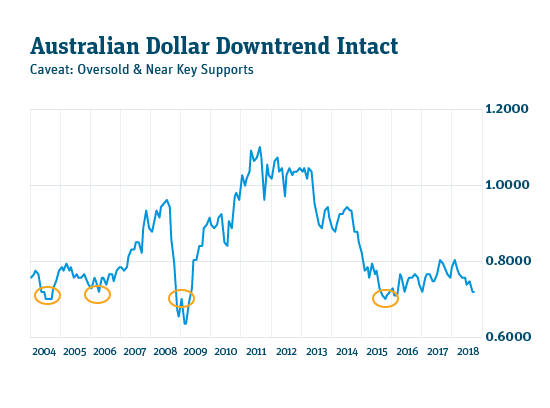

The AUDUSD downtrend is intact as it approaches 2½ year lows, just under $0.70. However, the charts provide a few signals that may suggest a pause or even a reversal of that downtrend. First, the AUDUSD is technically oversold on short-term charts (not shown); second, $0.70 has served as a key turning point (yellow ovals) several times over the last 15 years; and lastly, $0.70 is considered by traders as a key psychological level (as it’s considered a major round number).

Final remarks

Summer is over, and FX traders around the world are back at their desks. Trading activity in the financial markets typically increases in September as traders build positions for the final push of the year. Often this renewed activity will either continue or reverse existing trends in a substantial way.

The fundamental and technical factors that have been driving the AUD lower are still relevant and intact, but there are signs that the end may be nigh.

For those firms effectively short AUD (those with expenses down under), it may make sense to take some chips off the table (it’s been a good run), and reduce exposure.

For those firms long the AUD, it may be better to hold tight and wait to see if that $0.70 support level holds. If it breaks with conviction, technical traders see $0.65 as the next target.

Next steps

Please feel free to contact us to discuss or for analysis particular to your situation at fxadvisors@svb.com

Contact your SVB FX Advisor for more on this analysis, and for solutions tailored to your needs.

Read our FX Risk Advisory article FX Forward Strategies for Volatile Emerging Markets.

Source: Bloomberg 2018.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.