Key Takeaways

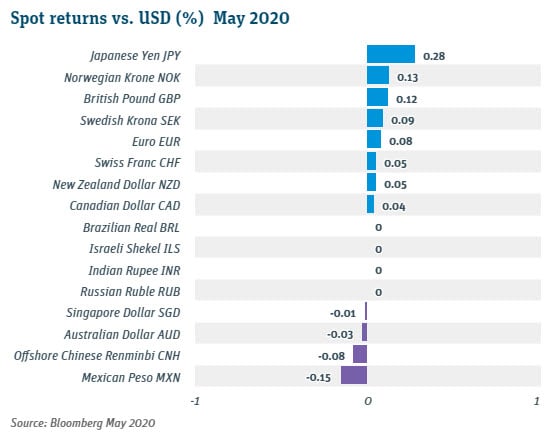

- Dollar returns to pre-pandemic levels as lockdowns ease, driving equities higher and safe-haven assets lower.

- China tightens grip on Hong Kong: China/US trade relationship may prove a longer-term obstacle to global economic recovery.

- The future of the euro is being tested as a German high court attempts to exert control over the European Central Bank at the same time the European Commission is pushing for a large pan-European E750B stimulus package.

The dollar gained significantly in March when the Covid virus first hit global economy. Much of those gains were given back in May as more countries around the world began to slowly lift lockdown restrictions giving hope of a rebound to financial markets. At the same time, one of last year’s biggest risks – US/China trade took a turn for the worst. The world’s two largest economies seemed to have agreed to get along last December leading to a couple months of positive market sentiment. Now the Phase-1 trade agreement seems in doubt and the overall relationship has again turned frosty.

What happened?

German court questioned ECB authority. Germany, questioning the fairness of the European Central Bank (ECB) asset-purchase program, has instructed its highest court to conduct a “proportionality assessment” in order to assess whether the country should continue participating in the program. Underway since 2015, the ECB has recently intensified the program to help mitigate the effects of the COVID-19 pandemic on eurozone nations. The role of the ECB as a pan-European entity, may be in jeopardy if one (or any) member nation could overrule its monetary policy stabilization efforts. As the policy is contended, some experts expect the euro could suffer in the near-term.

Oil price surge strengthened commodity currencies. Initially, COVID-19 drove the world’s supply/demand off balance resulting in an oil price crash. Then, as OPEC production decreased, and more recently, stay-at-home orders began to lift and cars began returning to the roads, the price of oil has been restored, with Brent prices increasing 40% in May and West Texas Intermediate almost doubling. Australian and Canadian dollars strengthened 20% and 7% respectively since March lows.

George Floyd killed. Just as the US economy was struggling to come back online following the COVID-19 lockdown, the killing of George Floyd and resulting protests could potentially worsen the pandemic globally. Coincident with a weakening US dollar and strengthening equity market, financial markets appear unaffected by the event. Many believe that the deep sense of unease which has followed Mr. Floyd’s death however, may weaken overall consumer confidence and impact the fall elections.

What’s in play?

European Commission proposes stimulus. The European Commission, the executive branch of the European Union responsible for proposing legislation across the EU, has proposed a €750B spending program to help member nations recover from the economic effects of COVID-19. Some individual EU countries, especially in the north, have questioned the fairness of the grants for other countries (mostly those in the southern Europe). The spending program, should it pass, will further financially integrate eurozone nations. Financial markets cheered the stimulus effort with the euro enjoying a 5-day rally after the EC announcement.

US/China tensions renew fears of protracted trade war. China’s president Xi Jinping sees his country emerging from the pandemic stronger relative to the US and other countries. Even so, as the country seeks to impose new national security laws on Hong Kong, potentially disrupting the “one country, two systems” accommodation for the city in place since the early 1980s, many believe President Trump may further harden his stance against the country—especially during this election year. Although investors may see the negative economic impact of COVID-19 as transitory, trade impasses between the US and China could continue for the long-term.

Foreign Direct Investment scrutinized. The Organization for Economic Cooperation and Development (OECD) projects Foreign Direct Investment (FDI) to shrink 30% in 2020. The fall-off may be explained in part to COVID-19, but analysts believe the imposition by developed member nations of barriers to investment following suspicious trade practices may be responsible for the larger share of the fall-off. Even with the decline in foreign direct investment, exchange markets are unlikely to be impacted by reduced cross-border payments.

What’s next?

EU and UK talk trade. With the UK scheduled to leave the EU on December 31 this year, about 6 months remain to hammer out an intricate trade deal – something that often takes years. If the completion of a stable agreement by year-end remains uncertain, and if protracted deliberations continue into 2021, market watchers expect the UK pound to sink. EU currencies are also expected to be unfavorably impacted should negotiations stumble. Investors may expect exchange rate volatility as politicians trade soundbites and central bankers highlight risks of no agreement.

Vaccine developed at ‘warp speed.’ The financial press has begun to speculate on which countries will recover first/fastest/healthiest from the economic shock suffered from the COVID-19 lockdown. Estimates hinge primarily on the availability of a widely-distributed vaccine. The US government launched Operation Warp Speed to dramatically reduce the time to produce a vaccine. Even so, big pharma executives say it could take a year or more. Uncertainty favors safe-haven currencies like the US dollar, Japanese yen and Swiss franc. The likelihood that richer nations will distribute a vaccine more quickly and therefore return to economic normalcy sooner will favor same safe-haven currencies and include the euro and renminbi.

Global debt expands. The OECD projects additional spending related to the COVID-19 pandemic to drive global national debt levels to 137% of GDP (up from 109% in 2019)—an increase that would normally be seen over a generation will take just about a year. COVID-19 has driven some currencies to historically low levels, including the Turkish lira, Indian rupee and Brazilian real, and could materially affect their ability to borrow.