The Brexit saga continues with no agreement between the PM and Parliament. Theresa May has suggested that the end of March deadline might be extended. Trade negotiations between the US and China have made some headway. The rather surprising outcome was that the pound strengthened during the month, outpacing the strengthening dollar.

What's in play

Brexit developments. The Brexit time frame appears to have become more flexible as we approach the March 29 deadline. The new uncertainty caused cabinet Minister for Farming, George Eustice to resign. These different factors added to the pound’s volatility. The pound’s direction from here is very difficult to forecast as there are too many variables.

US-China trade issues. US trade negotiations with China have made headway, and an agreement may be signed when Trump meets with Xi. China agreed to buy about $200 billion worth of farm equipment and other goods from the US. The Chinese yuan strengthened in February, but ended the month almost unchanged from the end of January.

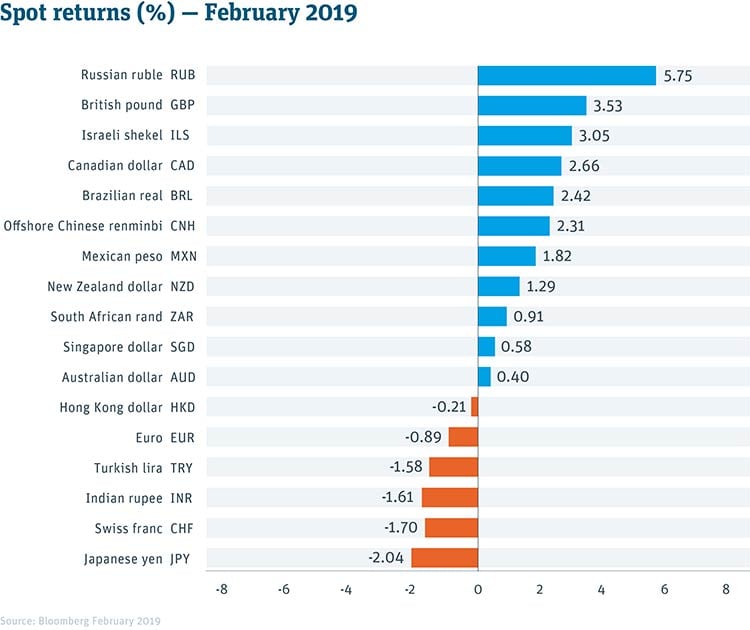

Major and emerging market currencies declined across the board against the US dollar this month with the exception of the British pound.

US-North Korea peace talks fell apart abruptly when Trump left the table. The Japanese yen weakened on the breakdown in talks with North Korea, losing about 1 yen to the dollar.

What's next

Global Growth. ECB Head Mario Draghi and a number of central bankers are concerned that global growth is showing signs of contraction. This will hold back the euro despite any news that favors the euro.

The Federal Reserve. Chairman Jerome Powell repeated that he is taking a patient stance on any interest rate changes as he watches uncertainties in the economy. With no interest rate hikes likely, the dollar should hold steady as interest rate differentials remain unchanged.

The ECB. Mario Draghi said he has no change in the interest rate outlook and is sticking with his cautious approach. The prospect of more funding from the ECB is becoming more likely. This changes the bias in favor of and could weaken the euro, given the continuing push higher by the dollar.

What happened

More certainty prevailed during February. US bond yields rose due to increased caution from the Federal Reserve.

Stocks rallied through the month as chances of a trade war with China receded and as Trump extended his trade tariff deadline. Positive comments from both Trump and the Chinese top trade negotiator Lui He increased confidence and risk appetite.

The US Government funding bill extended funding to September 30, averting another government shutdown.

The Canadian dollar declined at the end of the month as Canadian GDP came in lower than expected. Falling oil price also drove the loonie lower in volatile trading at the end of February.

Talk to us

A focus on foreign exchange usually requires proactive efforts to safeguard cross-border business. We can help you to reduce your currency risks.

SVB’s FX team has been ranked by Bloomberg as one of the most accurate FX forecaster in the world.* We leverage unique expertise to provide you with the ideas to help protect your business in turbulent times.

If you’d like to discuss your specific situation or to explore the merits of active FX management, contact your SVB FX Advisor directly, or email us at fxadvisors@svb.com.

Learn more

Explore additional SVB guidance on FX management:- FX Risk Advisory: How currency movements can affect your global business

- FX Risk Advisory: The Chinese renminbi may move as market uncertainty rises

- Five themes that matter to FX markets in 2019

- India’s capital markets suffer heavy selling – rupee lower

- New Taiwan dollar low volatility

- See an overview of our full FX services on www.svb.com

Data sources: Bloomberg 2019

*Bloomberg Q3’ 2018 FX forecasters are ranked based on three criteria: margin of error, timing (for identical forecasts, earlier ones received more credit) and directional accuracy (movements with the currency’s overall direction). The rankings which were based on Bloomberg’s foreign exchange forecasts (FXFC), were for forecasters who provided forecasts for Q3’ 2018 in at least three of the four preceding quarters but no later than one month prior to September 30, 2018.

Scores were calculated each quarter for the three criteria, which were weighted 60 percent, 30 percent and 10 percent, respectively. The final score for each currency pair was the time-weighted average of the four quarterly scores.

The best overall forecasters were identified by averaging the individual scores for each firm on all 13 currency pairs and all four quarters. Forecasters had to be ranked in at least eight of the 13 pairs to qualify for the overall ranking (54 firms qualified). All ranking tables display the top 20 percent of the forecasters who were eligible, to a maximum of 10 names.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.