2019 is an exciting year for life science and healthcare exits, as our SVB colleague Jonathan Norris recently shared in his 2019 Mid-Year Healthcare Investments and Exits Report.

The strong exits environment is prompting healthcare executives to plan for an IPO or M&A at earlier stages. As a rule of thumb, if you are within 12 months of a possible exit, you should take steps now to help you attain the best outcome for building your personal wealth.

Even before you start interviewing underwriters, identify a financial advisor experienced in planning around IPOs/M&A and consult tax and estate-planning professionals. The goal is to get experts to help you prepare a strategy well in advance of a liquidity event.

The transition moving from having “paper wealth” in a company to holding concentrated liquid wealth to creating diversified liquid wealth is complex growth. And as you move toward a diversified portfolio, wealth preservation may become more of a priority or you may decide you want to carve out some funds for private investments, including real estate, startups or targeted funds.

Here are key steps and questions to help you plan:

What are your goals?

To make decisions around exercising options or transferring wealth (either via irrevocable trusts or philanthropic planning), you need to understand the risks and tradeoffs. While tax minimization may be part of this plan, you should remember that exercising options early or transferring wealth has major tax implications. Setting goals and identifying priorities with your advisors will help guide your decision-making.

What tax exemptions are most relevant?

If you joined as a founder or early employee of a successful early-stage healthcare company before it raised total of $50M, some or all of your shares may be eligible for the qualified small business stock (QSBS) exemption. This may protect up to $10 million (or 10 times your cost basis, whichever is greater) from federal taxes. To determine this, you need proper documentation. Ask your company auditor or accountant to prepare a memo identifying which shares on the cap table may qualify. Understanding these tax implications are critical before you make decisions on how and when to exercise options, trade stock or transfer/gift any of your shares. You miss this exemption on shares exercised from options after the company raises more than $50M in total funding.

For a deeper explanation of QSBS, please read Understanding Qualified Small Business Stock and the Capital Gains Exemption.

Is it better to exercise or hold stock options?

Let’s discuss key decisions around exercising options. Deciding when to exercise incentive stock options (ISOs) is critical and should be reviewed near the end of each year. The ability to exercise ISOs without paying alternative minimum tax (AMT) is a great incentive, and the benefits may change from year to year, depending on your personal tax situation. The 2017 tax law reform changed AMT slightly, and it may be more advantageous to exercise ISOs in 2019 and later than previously. Ask your tax advisor to model the cost of exercising vs. the expected gain. A key milestone to consider is when your company moves from getting annual to quarterly 409(a) valuations. Often, this is the point when the price spread between common and preferred shares narrows rapidly. It is also very important to recognize that exercising options often means taking on additional risk and should not be viewed only as an opportunity to minimize taxes. For example, you may choose to hold your options risk-free until the expiration date, and if you go public, then sell the shares simultaneously with the exercise to mitigate risk. Of course, this likely will result in paying a higher tax rate on the gains.

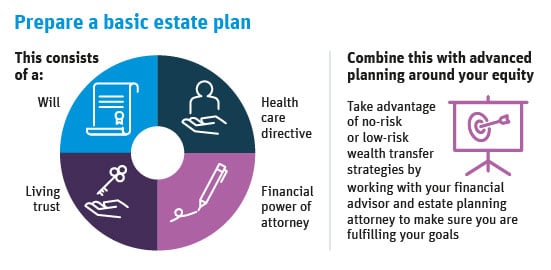

How will liquidity activity affect my estate planning?

If you don’t have an estate plan already, this is a critical time to create a basic plan that includes a will, living trust, health care directive and financial power of attorney. You’ll need these pieces in place before you begin any advanced estate planning. You should carefully consider your goals before deciding which type of trust structure to put in place. Much like stock option exercises, this may be one of the best times to take advantage of wealth transfer strategies. Post-2017 tax law and indexed for inflation, in 2019 lifetime gifting and estate tax exemptions increased to $11.4 million for an individual and $22.8 million for a married couple. These higher exemption levels carry sunsets in 2025, so plan ahead.

How do I time liquidity?

Commonly in healthcare company financing, a large round is followed by a secondary sale, both ahead of an IPO. Secondary sale transactions may be worthwhile to explore when weighing the true total costs of selling at a discount and/or financing through the pursuit of unsecured or restricted stock loans prior to an IPO. Depending on liquidity needs and ability to qualify for financing, a secondary sale may be beneficial to tap some liquidity for option exercises and help mitigate the risks of holding concentrated stock.

You likely will be unable to sell shares until the end of the underwriters’ lockup period, which typically restricts sales for six months after an IPO. Provided you are still with the company six months later, you will likely be subject to internal trading windows that may not be open at the end of the lockup period, Additionally, many companies that have a successful IPO decide to hold a secondary transaction prior to the end of the lockup, which can extend the lockup period and lengthen the time to liquidity.

There are tools to tap liquidity in advance, including a bridge loan or restricted stock loan just prior to the IPO (Silicon Valley Bank offers this type of loan in certain circumstances). While you may be able to pledge shares to obtain a loan before an IPO, this may not be the case post-IPO, if you are an employee. That’s why understanding your liquidity and cash flow needs ahead of time is so important.

Often, we find that executives are very enamored of the idea that their company’s stock will only go up, and they ignore the potential downside risk. Too many things are outside the control of a company, such as recessions, black swan events and changing business environments. Many paper fortunes have been wiped out in past market cycles. Individuals should devise a diversification strategy to reduce concentrated positions and stick to their liquidity plan.

What is SVB’s view on understanding IPO risks?

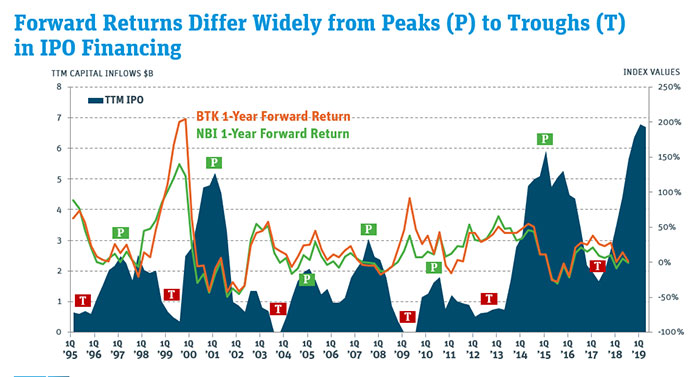

Geoff Borges, SVB Leerink Director of Therapeutics Research, explained in his recent discussion, "Chasing Unicorns", with Jonathan Norris, that there are drastic differences in forward-returns in trough periods vs. peak periods. He studied six peak periods and five trough periods between 1995 and the present and found that forward-returns in trough periods had an average return of 50% compared with 15%-20% in peak periods.

Source: SVB Healthcare report July 2019

How can I gain more flexibility?

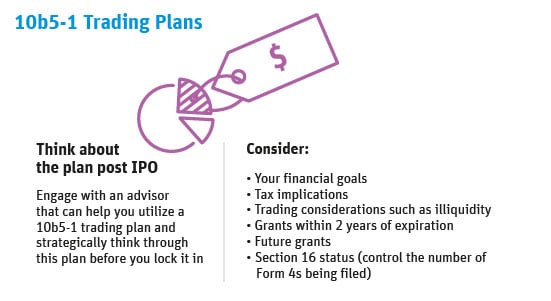

First, you need a clear understanding of your limitations on selling shares post-IPO. Will you be a Section 16 officer or an insider? Either way, you will likely want to use a 10b5-1 trading plan. This type of plan typically requires liquidation planning a year out or longer, but it allows you to sell shares in the future regardless of trading windows. Companies going public generally put tight restrictions around executives’ ability to implement such plans. It is recommended that you begin thinking about the plan post-IPO but before any lockup ends. At this point you may have more visibility into where the stock is trading. Before going ahead, you will want to work with your advisory team to craft a strategy that considers your financial goals, tax implications, grants expiring within two years and future grants

When do I devise an investment strategy?

Before you trade shares, you will want an investment strategy in place. As discussed above, portfolio diversification is highly advised. The best plan establishes desired liquidity levels first, then sets the investment decisions. That’s why it is important to think hard about your long-term goals so that you may properly fund an investment strategy. The more disciplined you are in applying the strategy, the more likely you are to reach those goals.

How can I align personal giving with tax mitigation strategies?

Many healthcare executives are interested in personally funding healthcare research to spur innovation, and often this is done through a charitable-giving plan. Accounts such as donor advised funds and charitable giving funds allow you to make contributions in high-tax years but then spread out the gifts over a period of time. By gifting stock, you can often avoid paying taxes on large gains and keep those dollars in the fund earmarked for charity. If you are considering significant wealth transfer through philanthropy, you may want to consider a private foundation. Again, these are complex decisions with significant implications for tax planning and your personal finances.

On a final note, when planning for an IPO, it is important to properly assess risk and reward for your own personal finances. People often focus solely on tax minimization and don’t understand that they may be taking on excess risk in the meantime. Sometimes, irrational exuberance takes hold causing individuals to want to hold on to their stock and deviate from their plan, but this can be a serious mistake. Be sure to tap experts who can help you identify your goals and gauge your tolerance for risk, cost and complexity. Your Private Bank Relationship Manager can help guide you with a full understanding of how to best manage your dynamic and growing balance sheet and connect you to the correct professional advisors.

To learn more about the impacts of the 2017 tax reform on liquidity issues, please read How New Tax Reforms Impact Investors and Entrepreneurs.

View our infographic that outlines the financial planning steps to take before an IPO for Executives.