Fintech Companies Cite Regulatory Hurdles as Biggest Impediment to Growth in 2016, according to Silicon Valley Bank Survey

Company news | November 17, 2015

New York City – November 17, 2015 – According to a survey released today by Silicon Valley Bank, the bank of the world's most innovative companies and their investors, fintech company founders and investors expect regulatory issues to be the biggest impediment to their success in the coming year. The survey examined issues that are top of mind for startup companies interested in disrupting traditional financial services.

"The attendees at the Fintech Mashup event validated what fintech companies around the world have been voicing in recent years – an effective regulatory and compliance strategy is critical to their ultimate success," said Bruce Wallace, Chief Digital Officer of SVB Financial Group. "As innovators continue to redefine innovative operating models across the financial services sector, it is important to us to help our clients navigate challenges as they identify opportunities to improve financial services for consumers and businesses."

The survey of 101 company founders and investors in the financial technology space was conducted at Silicon Valley Bank's Fintech Mashup on November 3 in New York City. During a series of presentations and panel discussions at the event, top executives joined SVB from companies such as Circle, InVenture, LearnVest and MasterCard and shared their insights in areas including alternative finance, digital currencies and commerce, API banking, payments, and compliance, among other topics.

Findings from the survey:

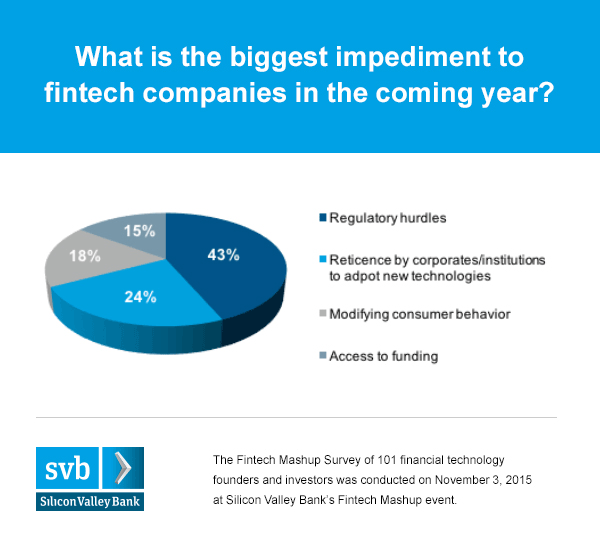

- Regulatory Hurdles Challenge Fintech – Nearly half of the survey respondents (43 percent) said regulatory issues were their biggest impediment, followed by reticence by corporations to adopt new technology (24 percent), changing consumer behavior (18 percent), and access to funding (15 percent).

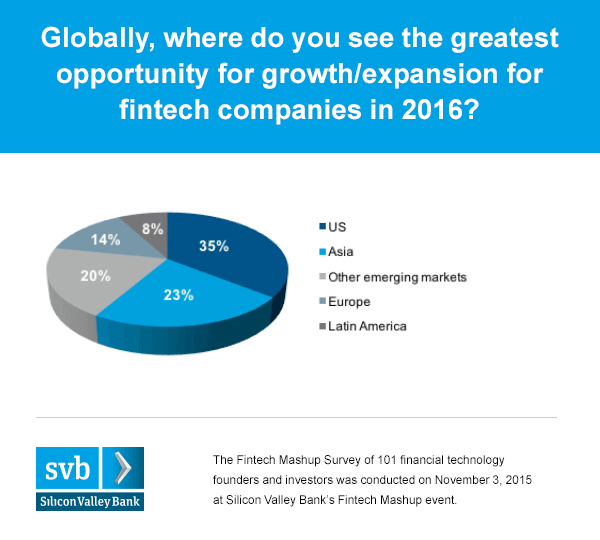

- Growth Anticipated in the US – Despite regulatory hurdles, the United States is viewed as the market with the greatest opportunities for growth and expansion for financial technology (36 percent), ahead of Asia (22 percent) and Europe (14 percent).

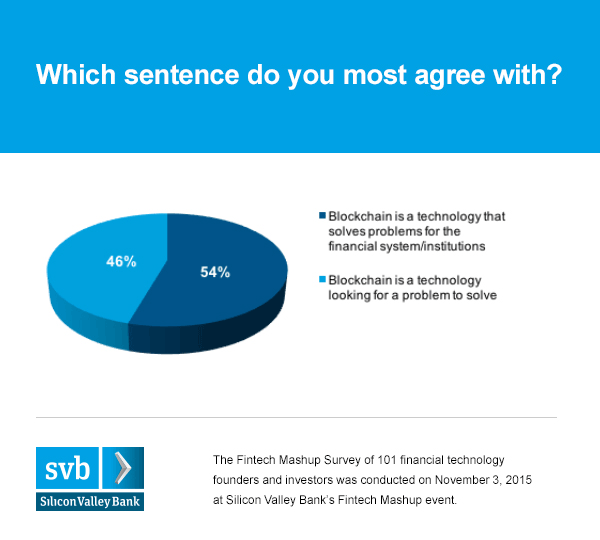

- Experts Mixed on Blockchain – Respondents were divided as to whether blockchain "is a technology looking for a problem to solve" (46 percent) or one that "is providing a solution for financial institutions" (54 percent).

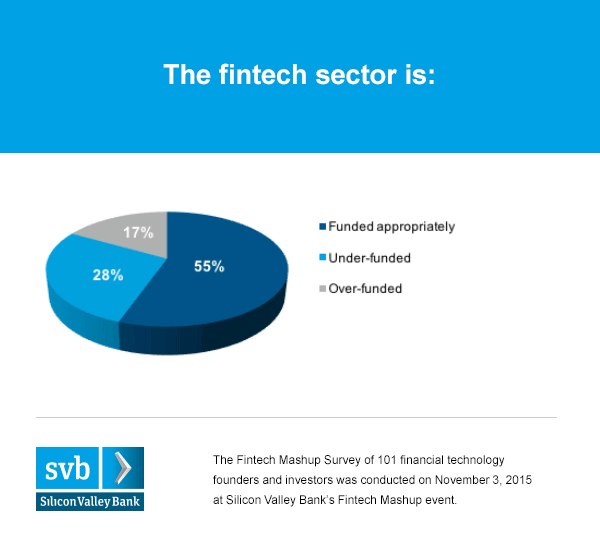

- Funding is Available – The majority of respondents (55 percent) believe that the financial technology sector is funded appropriately. In fact, only 17 percent feel that the sector is currently over-funded.

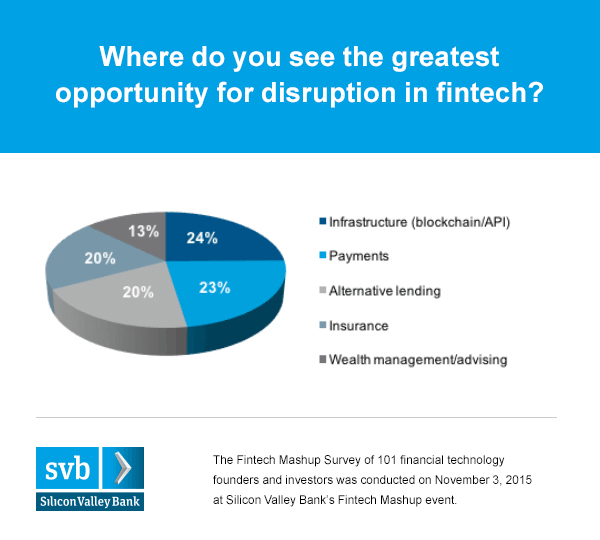

- Industry Disruption to Continue – When asked to identify the greatest opportunity for fintech disruption, "infrastructure" (including blockchain and API) was the top pick according to 24 percent of respondents. Results were nearly evenly split between payments (23 percent), insurance and alternative lending (both at 20 percent). Wealth management and robo advising were identified by just 13 percent of respondents.

The complete survey results are available below.

Editor's Note: The Fintech Mashup Survey was conducted on November 3, 2015 at Silicon Valley Bank's Fintech Mashup event. The 101 survey respondents, who were among the attendees at the Fintech Mashup, included financial technology founders and investors.

About Silicon Valley Bank

For more than 30 years, Silicon Valley Bank (SVB) has helped innovative companies and their investors move bold ideas forward, fast. SVB provides targeted financial services and expertise through its offices in innovation centers around the world. With commercial, international and private banking services, SVB helps address the unique needs of innovators. Forbes named SVB one of America's best banks (2015) and one of America's best-managed companies (2014).

Banking services are provided by Silicon Valley Bank, Member FDIC. SVB Financial Group and Silicon Valley Bank are members of the Federal Reserve System.